2025 State of Supplemental Income in America Report finds 71% of U.S. Workers Rely on Secondary Income Sources

Our customers have been hired at: *Foot Note

Faced with mounting financial pressures, nearly three-quarters of American professionals are increasingly seeking out secondary income sources. This trend reflects the need for greater financial stability in the face of rising costs and economic uncertainty.

However, while these additional income streams may offer financial relief, they also bring complex challenges that affect workers' professional performance and personal well-being.

The report, which polled 1,065 American professionals in December 2024, highlights key trends in secondary income sources, workers’ motivations for earning extra money and the ripple effects second jobs have on their work performance and personal lives.

Survey highlights:

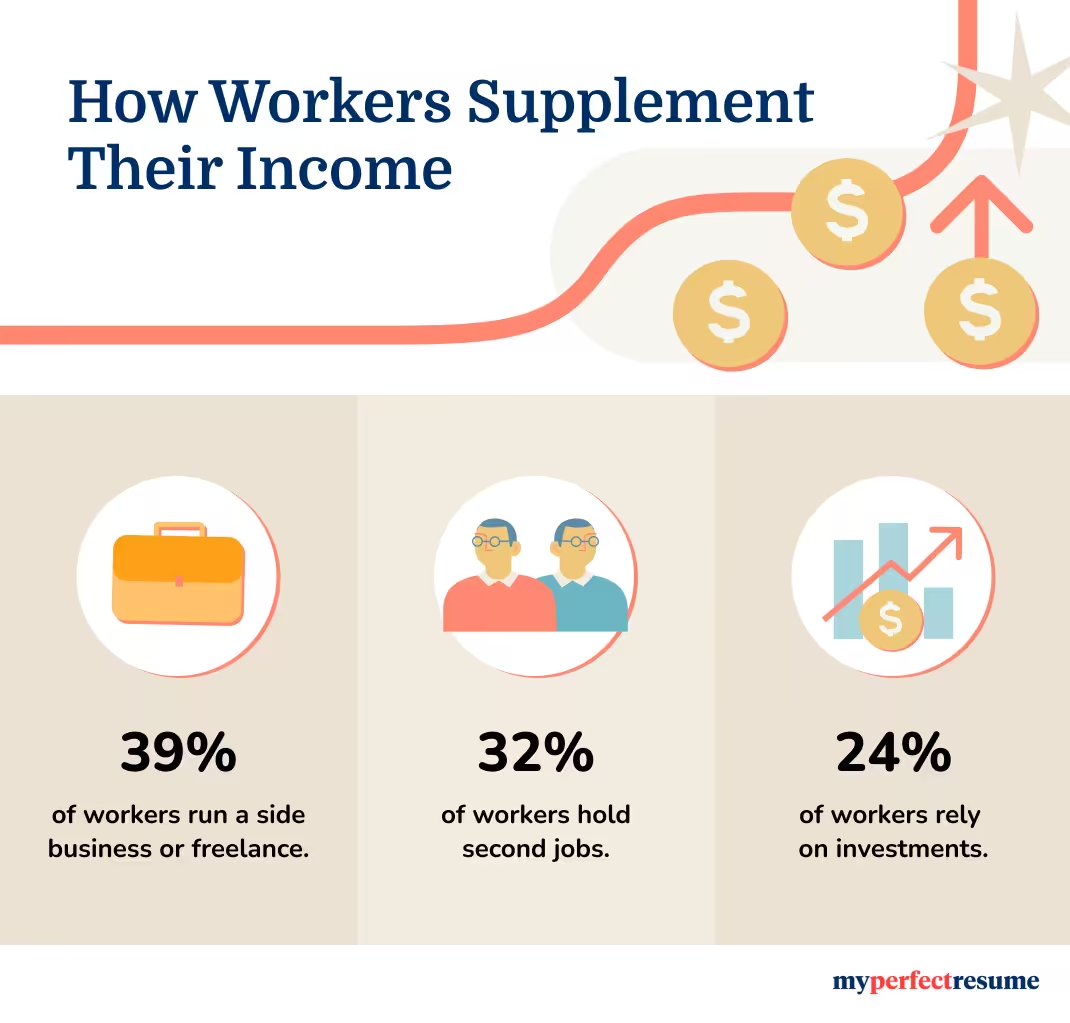

- Most workers rely on secondary income sources, such as side businesses, freelance work (39%), or second jobs with another employer (32%), for their financial well-being.

- Another 24% rely on investments, with only 5% relying solely on their primary job to meet their financial needs.

- Paying off debt or loans (42%), saving for major life goals (37%) and covering living expenses (35%) are top motivators.

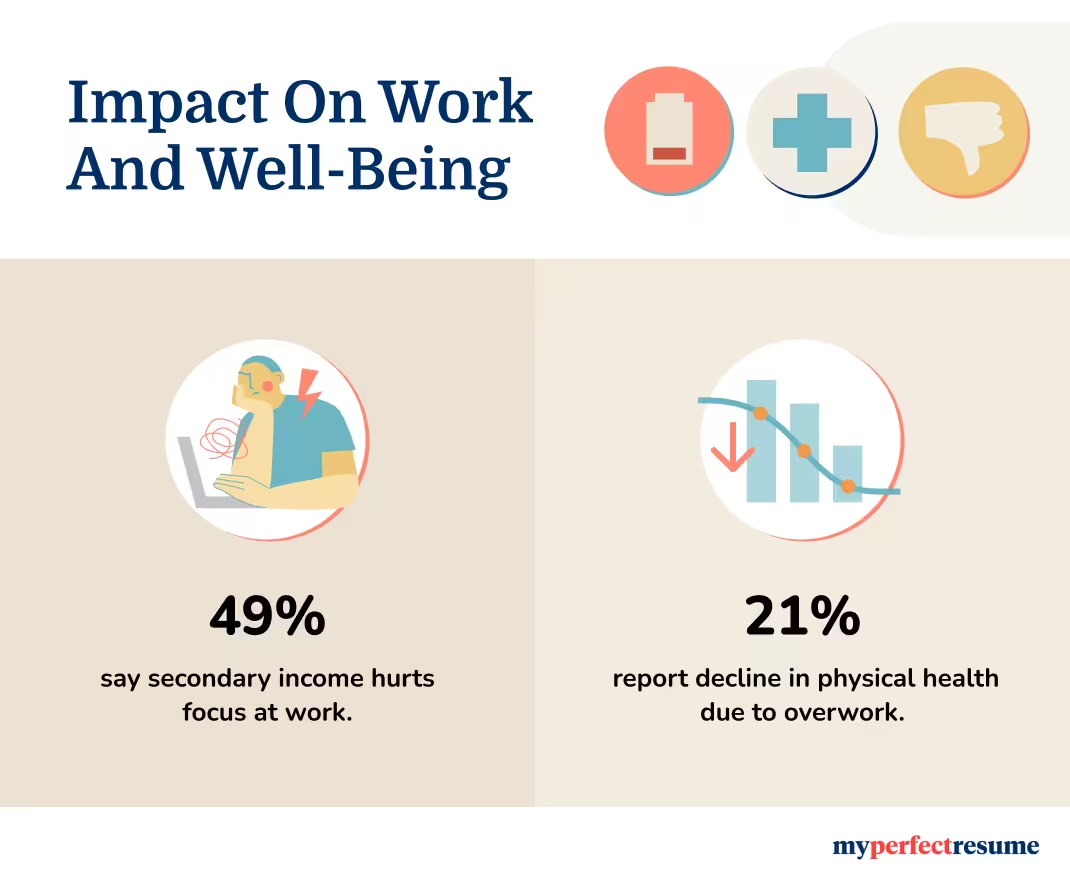

- 49% say having a second source of income hurts focus and performance at their primary job.

- 21% report a decline in physical health due to overwork.

- Men (44%) are more likely than women (35%) to own side businesses.

Secondary Income Sources: A Common Strategy for Financial Stability

Many workers turn to side businesses, freelance gigs and second jobs to make ends meet, illustrating the widespread need for additional income. There are a variety of ways workers approach earning additional income, including:

- 39% of respondents own a side business or freelance.

- 32% work a second job for another employer.

- 24% rely on investments such as stocks, bonds or cryptocurrency.

- Only 5% rely solely on their primary job for income.

There are some trends related to how workers are choosing to supplement their primary income:

- 44% of men own a side business compared to 35% of women.

- Men are more likely to rely on investments (25%) than women (23%).

- Higher-income earners ($100K+) are more likely to lean on investments (22%) for additional income.

What this means: The prevalence of secondary income strategies highlights the widespread need for financial security and individuals' diverse approaches to achieve it.

Top Motivations for Pursuing Additional Income

Workers cite a mix of financial responsibilities and aspirations as their primary reasons for seeking additional income sources. The following are the top financial pressures and lifestyle ambitions driving workers to take on more responsibilities:

- 42% want to pay off debt or loans, such as credit card debt or student loans.

- 37% want to save for major life goals, for example, buying a home or retirement.

- 35% need to cover basic living expenses, such as housing and groceries.

- 29% plan to build a financial safety net, such as building savings or creating an emergency fund.

- 23% hope to be able to afford non-essential items, like vacations or hobbies.

- 20% need to pay for childcare or school for their children.

What this means: The motivations driving secondary income efforts underscore the financial pressures many face and the role of additional earnings in achieving stability and long-term aspirations.

Impact on Work Performance

Earning extra money can have mixed effects on workers' focus on their main roles. Of those surveyed, nearly 49% say having a second income source hurts focus and performance, while 40% say it improves their focus and performance by reducing financial stress. Some (11%) say there is no impact on their primary job performance.

Women and low-income earners are more likely to report significant performance decline.

- Men are more likely to experience significant focus reduction (20%) than women (17%).

- Lower-income earners report significant focus reduction at higher rates (34%).

What this means: Secondary income efforts can strain workers' ability to perform in their primary roles, with significant implications for productivity and workplace dynamics.

Personal Life Sacrifices

For many, pursuing additional income has affected their lives, from health impacts to reduced leisure time. This report uncovered several sacrifices workers make to achieve financial goals.

- 21% report a decline in physical health due to overwork.

- 16% have sacrificed personal hobbies or interests.

- 16% have less time to spend with family or friends.

- 13% feel more burned out or stressed.

- 11% report no negative effects on their personal life.

Men and women experience the impact on their personal lives somewhat differently.

- 16% of women report health decline compared to 27% of men.

- Men are more likely (13%) to say their personal lives haven’t been negatively affected than women (9%).

What this means: The pursuit of additional income often comes at a cost to personal well-being, raising questions about sustainability and long-term impact on quality of life.

Key Takeaways

- Nearly three-quarters of American professionals are turning to secondary income sources to combat rising costs and financial uncertainty.

- While additional income provides financial relief, many workers are paying a price for their efforts, including a decline in focus at their primary job and worsened physical health.

- The findings underscore the challenges and sacrifices tied to achieving financial stability through multiple income streams.

Survey methodology

The findings were obtained by surveying 1,065 American respondents on December 11, 2024. They were asked questions about their sentiments around salary satisfaction, how they supplement their primary earnings and the challenges they face. These included yes/no questions, open-ended questions, scale-based questions relating to levels of agreement with a statement, and questions that permitted the selection of multiple options from a list of answers.

For press inquiries, please contact Elizabeth Buccianti, senior manager of public relations, at elizabeth.buccianti@bold.com.

Our customers have been hired at:*Foot Note