Why this resume works

- Quantifies accomplishments: Includes measurable accomplishments like processing over 1,000 invoices monthly and reducing discrepancies by 20%, illustrating a clear impact on financial operations.

- Showcases career progression: Career progression is showcased through roles as financial assistant, accounts payable coordinator, and accounts payable specialist, highlighting increasing responsibilities in invoice processing and vendor management.

- Highlights industry-specific skills: Industry-specific skills such as invoice processing, audit support, and payment compliance demonstrate strong administrative skills crucial for financial roles.

More Accounts Payable Specialist Resume Examples

Our accounts payable specialist resume examples provide valuable insights into showcasing your invoice processing, vendor management, and reconciliation skills. Use these billing and collections resume samples to create a strong resume that emphasizes your financial expertise and relevant experience.

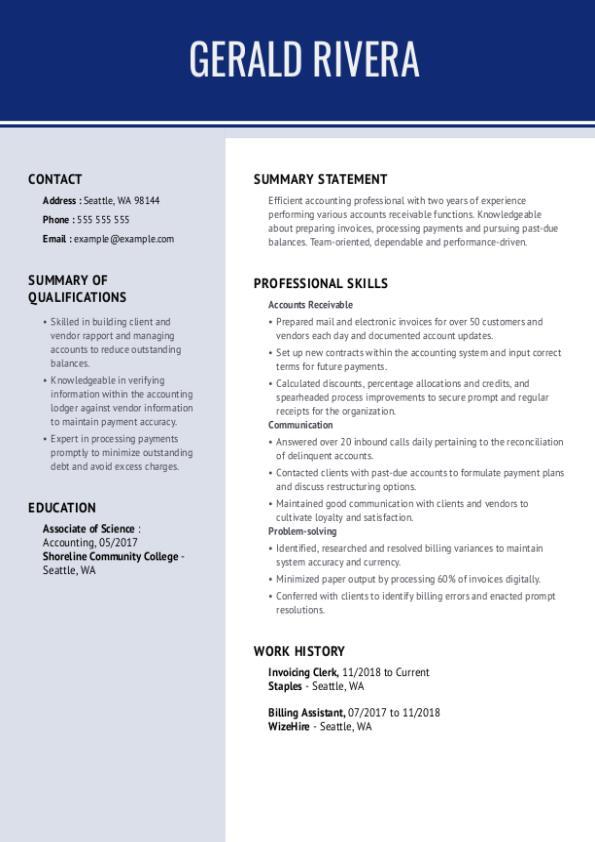

Entry-Level Accounts Payable Specialist

Why this resume works

- Touches on accomplishments: Highlights commendable achievements like implementing new AP software that reduced processing time by 40%, underscoring the candidate’s recognized excellence in their field.

- Features education section: Clearly structured, the education section emphasizes academic accomplishments from reputable institutions, showcasing a solid foundation in finance and accounting pivotal for early career professionals.

- Shows digital literacy: Digital literacy and computer skills are showcased through references to automated payment systems and AP software implementation, illustrating readiness for modern financial operations and technological adaptation.

Mid-Level Accounts Payable Specialist

Why this resume works

- Hones in on real impact: Effectively highlights the tangible impact of reducing late fees and improving vendor satisfaction, emphasizing clear value to potential employers through measurable results.

- Includes a mix of soft and hard skills: A balanced skill set is evident through the combination of technical invoice processing, analytical reconciliation tasks, interpersonal skills, and vendor management responsibilities.

- Displays technical expertise: Technical expertise shines through detailed mentions of proficiency with accounts payable software, professional certifications, and specialized financial reporting skills.

Experienced Accounts Payable Specialist

Why this resume works

- Lists relevant certifications: The resume clearly outlines certifications like Certified Accounts Payable Professional and Microsoft Excel Expert, underscoring expertise and commitment to professional development.

- Showcases impressive accomplishments: Noteworthy accomplishments like reducing late payments by 15% and cutting processing errors by 20% illustrate a significant impact on financial operations at a senior level.

- Sections are well-organized: Sections with clear headers and concise bullet points enhance readability, making it easy for readers to quickly scan and grasp key information.

Accounts Payable Specialist Resume Template (Text Version)

Emma Nguyen

Indianapolis, IN 46202

(555)555-5555

Emma.Nguyen@example.com

Professional Summary

Experienced Accounts Payable Specialist with a proven track record of optimizing payment processes, increasing efficiency through automation, and ensuring compliance. Adept at managing high volumes of invoices and maintaining accurate records.

Work History

Accounts Payable Specialist

Zenith Financial Services – Indianapolis, IN

January 2021 – March 2025

- Processed over 1,000 invoices monthly

- Reduced late payments by 30%

- Reconciled accounts with 98% accuracy

Accounts Payable Coordinator

Prime Accounting Solutions – Greenfield, IN

January 2017 – December 2020

- Managed vendor inquiries, resolving 95%

- Improved automation, saving K/year

- Ensured timely payments, maintaining 100% compliance

Financial Assistant

McKenzie Financial Group – Indianapolis, IN

January 2016 – December 2016

- Supported accounts payable department

- Assisted with audits, reducing discrepancies by 20%

- Coordinated financial records with 100% accuracy

Languages

- English – Beginner (A1)

- Spanish – Beginner (A1)

- French – Intermediate (B1)

Skills

- Invoice Processing

- Accounts Reconciliation

- Vendor Management

- Financial Reporting

- Audit Support

- Payment Compliance

- Automation Implementation

- Data Analysis

Certifications

- Certified Accounts Payable Professional (CAPP) – Institute of Finance & Management

- Certified Management Accountant (CMA) – Institute of Management Accountants

Education

Master of Business Administration Finance

Stanford University Stanford, California

May 2016

Bachelor of Science Accounting

University of California, Berkeley Berkeley, California

May 2014

Popular Skills for a Accounts Payable Specialist Resume

A strong resume skills section is essential for an accounts payable specialist, highlighting expertise in financial software and accounting along with soft skills such as attention to detail and communication. This blend of abilities ensures efficient payment management and effective teamwork.

Below are a few of the top soft skills frequently listed on accounts payable specialist resumes.

| Soft Skills | % of resumes with this skill |

|---|---|

| Vendor relations | 31.82% |

| Problem resolution | 25.00% |

Here are a few examples of hard skills frequently included on accounts payable specialist resumes.

| Hard Skills | % of resumes with this skill |

|---|---|

| Invoice processing | 50.00% |

| Payment processing | 38.46% |

| Entry verification | 38.46% |

| Statement reconciliation | 36.00% |

| Data inputting | 35.90% |

Related Resume Guides

Advice for Writing Your Accounts Payable Specialist Resume

Explore our tailored tips on how to write a resume for an accounts payable specialist role and discover how to highlight your financial expertise, attention to detail, and ability to manage vendor relationships.

Highlight your most relevant skills

Listing relevant skills when applying for a job is crucial, especially for an accounts payable specialist. It shows employers you have the abilities needed to succeed in the role. Create a dedicated skills section that balances technical skills, like proficiency in accounting software and invoice processing, with soft skills, such as attention to detail and communication.

Organize your ‘Skills’ section by listing the most important technical skills first, then follow with interpersonal skills. For example: “Proficient in QuickBooks and Excel” followed by “Strong organizational and problem-solving abilities.”

To make your resume even stronger, integrate these key skills into your work experience section. Describe how you used these skills in past jobs to achieve specific results. For instance, mention how your attention to detail reduced invoice errors or how your communication skills improved vendor relationships.

By clearly showing both types of skills and providing examples of how you’ve used them effectively, you’ll demonstrate that you’re well-equipped for the accounts payable specialist position. This approach helps potential employers see not just what you can do but also how you can contribute to their team.

In your resume, include keywords from the job listing to improve your odds with applicant tracking systems (ATS) and grab the recruiter’s eye.

Showcase your accomplishments

When listing your work experience as an accounts payable specialist, organize your jobs in reverse chronological order. Start with the most recent position and work backwards. Each job entry should include your job title, the employer’s name, location, and employment dates.

To make your resume stand out, focus on quantifying your accomplishments rather than just listing duties. For instance, instead of saying “handled invoices,” you could say “processed over 500 invoices per month with a 99% accuracy rate.”

Highlight achievements that show measurable results like percentages, time savings, cost reductions, or efficiency improvements. Use action verbs such as “implemented,” “reduced,” or “improved” to describe these achievements.

Quantified accomplishments help hiring managers quickly see the impact and skills you bring to the table. They provide concrete evidence of what you can achieve as an accounts payable specialist and set you apart from other candidates who may only list generic duties.

5 accounts payable specialist work history bullet points

- Processed and verified invoices for accuracy, achieving a 99% error-free rate.

- Implemented an automated invoice tracking system, reducing processing time by 40%.

- Reconciled vendor statements and resolved discrepancies, saving the company $50,000 annually.

- Collaborated with vendors to negotiate payment terms, improving cash flow management by 20%.

- Led a project to digitize records, cutting paper usage by 60% and enhancing data retrieval efficiency.

Choose a clean and straightforward resume template with clear headings and legible fonts. Excessive design features or elaborate fonts can divert attention from your qualifications.

Write a strong professional summary

A professional summary for an accounts payable specialist is a short statement at the top of your resume that showcases your key skills, experience, and achievements in the role. It aims to capture the employer’s attention quickly and create a strong first impression.

If you have extensive experience in accounts payable, use this section to highlight your expertise and notable accomplishments.

For instance, “Detail-oriented accounts payable specialist with over 5 years of experience managing invoices, processing payments, and ensuring compliance with financial regulations.”

For candidates with limited work experience, using a resume objective is more suitable. It focuses on your career goals and what you aim to achieve in the position.

An example might be: “Motivated recent graduate seeking an accounts payable specialist position to apply strong analytical skills and dedication to maintaining accuracy in financial records.”

Use action verbs like “managed,” “processed,” or “ensured” to describe your responsibilities and achievements. Emphasize specific skills such as proficiency in accounting software, attention to detail, or effective communication within the team.

Accounts payable specialist resume summary examples

Entry-level

Detail-oriented accounting graduate with a bachelor’s degree in finance and a certification in Accounts Payable from the Institute of Financial Operations. Proficient in Microsoft Excel, QuickBooks, and SAP. Eager to apply foundational knowledge of invoice processing, vendor management, and financial reporting to support accounting operations in a dynamic organization.

Mid-career

Results-driven accounts payable specialist with over 5 years of experience managing full-cycle accounts payable processes for mid-sized companies. Adept at streamlining workflows, ensuring compliance with financial regulations, and maintaining positive vendor relationships. Proven track record of reducing invoice processing times by 20% through process improvements and automation.

Experienced

Highly skilled accounts payable specialist with more than 10 years of experience in high-volume environments. Expertise in team leadership, strategic vendor negotiations, and implementation of advanced AP systems like Oracle and Netsuite. Recognized for driving cost-saving initiatives that resulted in a 15% reduction in operational expenses while maintaining accuracy and efficiency in payment processing.

Accounts payable specialist resume objective examples

Recent graduate

Diligent and detail-oriented recent graduate with a degree in accounting seeking an entry-level accounts payable specialist position. Bringing strong analytical skills, proficiency in accounting software, and a solid understanding of financial principles to contribute to the efficient management of accounts payable processes.

Career changer

Resourceful professional transitioning into the role of accounts payable specialist, with extensive experience in administrative support and data management. Eager to apply organizational abilities, attention to detail, and commitment to accuracy in a dynamic finance team environment while gaining expertise in accounts payable functions.

Specialized training

Detail-driven entry-level candidate with specialized training in accounting software such as QuickBooks and SAP, seeking an accounts payable specialist role. Passionate about utilizing technical skills and a thorough understanding of financial documentation to ensure timely and accurate processing of invoices and payments.

Use our Resume Builder to quickly create a polished resume. It offers templates that highlight your skills as an accounts payable specialist.

Match your resume to the job description

Customizing your resume to align with job descriptions is vital as it enhances your visibility to employers and helps you pass through applicant tracking systems (ATS). ATS software scans for specific keywords in resumes, and without them, your application might not be reviewed by a human.

To create an ATS-friendly resume, it is essential to thoroughly review the job posting and identify key skills and phrases that describe the employer’s needs for an accounts payable specialist.

To achieve this, focus on the skills, qualifications, and responsibilities highlighted in the job listing. For instance, if terms like “invoice processing,” “vendor management,” and “reconciliation” are mentioned, ensure these keywords are incorporated into your resume appropriately. You can seamlessly embed these terms within your skills section or throughout your work experience bullets.

For example, if the job description states “Ensure timely invoice processing and reconciliation,” you might translate this into a resume bullet point such as: “Processed and reconciled invoices promptly to maintain accurate financial records.”

This approach not only aligns with key phrases but also illustrates how you have utilized these skills in previous positions. By thoughtfully integrating keywords from the job description into your targeted resume, you can enhance its ATS compatibility and boost your chances of securing an interview.

Use our ATS Resume Checker to make sure your resume gets seen. It finds problems and gives you tips to make your resume better for job applications.

FAQ

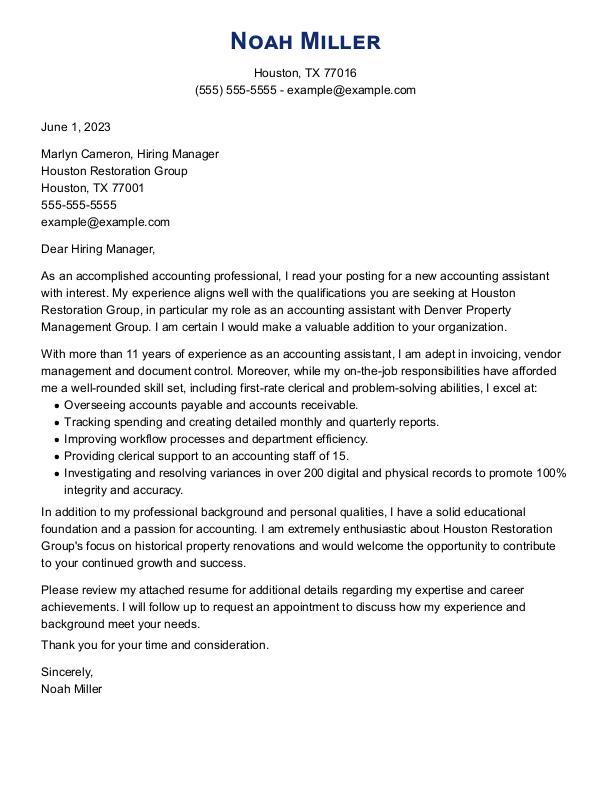

Do I need to include a cover letter with my accounts payable specialist resume?

Including a cover letter with your accounts payable specialist resume can make a significant difference by showcasing your attention to detail, proficiency with financial software, and ability to manage invoices efficiently.

Check out our library of cover letter examples to see how you can highlight key skills for this role and explain why you’re passionate about the position.

If you’ve implemented a new system that reduced payment processing time in a previous job, mention it to show initiative and problem-solving abilities.

Tailoring your cover letter to address the company’s goals or challenges demonstrates that you’ve done your homework and are genuinely interested in contributing to their success.

Use our Cover Letter Generator to create a polished document that sets you apart from other candidates by highlighting not just what you’ve done, but how you’ve excelled in those tasks.

How long should a accounts payable specialist’s resume be?

An accounts payable specialist’s resume should ideally be one page to concisely highlight your most relevant skills and experiences without overwhelming the reader.

Focus on showcasing key responsibilities like invoice processing, reconciliations, and vendor management. Explore our guide on how long a resume should be for additional tips and examples.

If you have extensive experience or significant achievements in the field, a two-page resume can also be acceptable. Emphasize recent roles and accomplishments that showcase your expertise and efficiency in managing accounts payable tasks.

How do you write a accounts payable specialist resume with no experience?

Creating a resume for an accounts payable specialist with no direct experience can be manageable by showcasing relevant skills and education. Begin with a compelling summary statement that highlights your enthusiasm for the role and key abilities such as attention to detail, organizational skills, and accounting software proficiency.

Next, focus on your educational background. Highlight any coursework in finance, accounting, or business administration related to accounts payable duties. Include any certifications you have in accounting software (like QuickBooks) or financial management.

In the experience section, list internships, part-time jobs, or volunteer roles where you managed financial records, processed transactions, or handled invoices. These experiences demonstrate relevant skills even if they weren’t specific to accounts payable positions.

Finally, emphasize transferable skills like data entry accuracy, problem-solving abilities, and Excel proficiency. See how to write a resume with no experience for additional guidance.

Rate this article

Accounts Payable Specialist

Additional Resources

Administrative Assistant Resume Guide + Tips & Examples

Accounts Receivable Clerk Resume + Tips + Example

Advance your career with a well-written accounts receivable clerk resume. This guide will help you create a professional resume for an accounts receivable clerk to highlight your skills and experience

Accounting Assistant Cover Letter Example & Templates

When you find a job you want, submitting a well-written resume is a good start, but it’s not enough alone. You also need to send a persuasive cover letter that

Billing Specialist Resume Guide + Tips + Example

Accounts Payable Cover Letter Example + Tips

Ava Taylor 1 Main Street New Cityland, CA 91010 Cell: (555) 322-7337 E-Mail: example-email@example.com Dear Ms. Flowers, I write in response to your ad seeking an Accounts Payable Clerk at Flowers Party Planning. As a highly

Payroll Specialist Resume Examples + Expert Tips

Explore payroll specialist resume examples to learn how to clearly highlight your expertise in payroll processing, compliance, and software proficiency. Use these samples and tips to craft a resume that