Why this resume works

- Quantifies accomplishments: By sharing measurable accomplishments, such as processing 150 loans monthly and improving approval rates by 25%, the applicant reveals their efficiency and effectiveness in finance roles.

- Showcases career progression: Starting as a financial consultant and progressing to a loan officer role, the applicant showcases a trajectory of increased responsibility and expertise within the finance sector.

- Highlights industry-specific skills: Industry-specific skills, such as credit analysis and regulatory compliance, demonstrate the applicant’s fit for financial roles and show a deep understanding of loan processing and risk assessment.

More Loan Officer Resume Examples

Our loan officer resume examples show how to showcase your financial expertise, interpersonal skills, and commitment to client satisfaction. Use these banking resume samples to craft a resume that emphasizes your strengths in the lending industry.

Entry-Level Loan Officer

Why this resume works

- Effective use of keywords: By weaving in keywords like “loan origination” and “portfolio management,” the applicant aligns their experience seamlessly with industry expectations.

- Shows digital literacy: The applicant’s computer skills and comfort with digital tools are evident through roles that required data-driven decision making, showcasing readiness for tech-driven workplaces.

- Centers on academic background: Academic credentials from top institutions, including a Harvard MBA, show a strong educational foundation important for early career progression and highlight key achievements.

Mid-Level Loan Officer

Why this resume works

- Points to measurable outcomes: Boosting loan application approvals by 15% in six months and managing $20M+ portfolios reflect an impressive focus on measurable outcomes and financial growth.

- Demonstrates language abilities: Language skills in Spanish, French, and German reflect the applicant’s ability to support cross-cultural communication in diverse financial environments.

- Includes a mix of soft and hard skills: Combining credit analysis with customer retention shows a mix of technical expertise and interpersonal skills, important for client-focused roles.

Experienced Loan Officer

Why this resume works

- Lists relevant certifications: By listing certifications like Certified Loan Officer and Financial Risk Manager, the applicant showcases their finance expertise and dedication to continuous learning.

- Showcases impressive accomplishments: Achievements such as reducing loan processing time by 20% illustrate impressive accomplishments that demonstrate significant business impact and senior-level performance.

- Emphasizes leadership skills: The applicant’s leadership skills shine through initiatives like launching automated systems, reflecting a proactive approach.

Loan Officer Resume Template (Text Version)

Chris Wang

Cleveland, OH 44105

(555)555-5555

Chris.Wang@example.com

Professional Summary

Seasoned loan officer with 8 years in finance, excelling in loan processing, risk assessments, and financial consultation. Proven track record of enhancing client portfolios and reducing default rates.

Work History

Loan Officer

FinancePro Lending – Cleveland, OH

January 2023 – June 2025

- Processed 150 loan applications monthly.

- Improved approval rate by 25%.

- Advised clients on loan risk factors.

Credit Analyst

SecureFin Solutions – Cincinnati, OH

June 2019 – December 2022

- Analyzed 200 loan applications monthly.

- Reduced loan default rate by 15%.

- Reported on creditworthiness trends.

Financial Consultant

BlueSky Consulting – Columbus, OH

January 2017 – May 2019

- Provided financial advice to 50 clients.

- Increased client portfolio by 30%.

- Conducted risk assessments biweekly.

Languages

- Spanish – Beginner (A1)

- French – Bilingual or Proficient (C2)

- German – Beginner (A1)

Skills

- Loan Processing

- Risk Assessment

- Credit Analysis

- Client Advising

- Financial Reporting

- Portfolio Management

- Data Analysis

- Regulatory Compliance

Certifications

- Certified Loan Officer – Loan Officer Accrediting Institute

- Credit Analysis Certificate – National Credit Association

Education

Master of Business Administration Finance

University of Illinois Champaign, Illinois

May 2016

Bachelor of Science Economics

Wisconsin State University Madison, Wisconsin

May 2014

Related Resume Guides

Advice for Writing Your Loan Officer Resume

Explore our tips on how to write a resume for a loan officer position and discover how to highlight your financial expertise, customer service skills, and ability to help clients secure the loans they need.

Highlight your most relevant skills

Listing relevant skills when applying for a job, like a loan officer, is very important. It helps to show that you have what it takes to do the job well. By creating a dedicated skills section, you make it easy for employers to see your strengths quickly.

Make sure this section includes both technical skills, like understanding loan procedures and financial analysis, and interpersonal skills, such as communication and customer service. This balance shows that you can handle the numbers side of things and also work well with people.

Integrating key skills into your work experience section makes them even more powerful. Instead of just listing skills, mention how you used them in past jobs. For example, describe how your ability to analyze credit reports helped approve loans quickly or how your communication skills improved client relationships.

This approach gives real examples of your abilities in action, making it easier for hiring managers to picture you succeeding in the role of a loan officer.

For loan officers, a resume format that emphasizes financial skills, customer service experience, and successful loan processing can improve your application.

Showcase your accomplishments

When showcasing accomplishments in your resume as a loan officer, it’s important to organize your work experience in reverse chronological order. This means starting with your most recent job and working back. For each position, include the job title, employer name, location, and employment dates. This structure helps employers quickly see where you’ve worked and what you’ve done recently.

Instead of just listing job responsibilities, focus on quantifying your accomplishments to make your resume more compelling. Turn duties into achievements by including measurable results like percentages or cost reductions.

For example, instead of saying “processed loans,” you might say “processed 150 loans monthly, increasing efficiency by 20%.” Use action-oriented words to describe how you made a difference in each role.

Quantified accomplishments help hiring managers quickly assess your impact and skills as a loan officer. They can see at a glance what you have achieved and how it has benefited past employers. Highlighting these achievements shows that you’re not just doing tasks but also contributing to the success of the company.

5 loan officer work history bullet points

- Processed and approved over 100 loan applications monthly, achieving a 95% approval rate and increasing branch revenue by 20%.

- Implemented a customer relationship management system that improved client follow-up efficiency by 30%, improving customer satisfaction scores.

- Conducted comprehensive financial assessments, reducing default rates by 15% through accurate risk analysis and borrower education.

- Trained and mentored junior loan officers, resulting in a 25% improvement in team productivity within six months.

- Collaborated with cross-functional teams to streamline the loan processing workflow, decreasing application turnaround time by 40%.

Pick a straightforward resume template with clear sections and a tidy design. Steer clear of excessive colors or graphics, ensuring employers can easily review your work history, skills, and education.

Write a strong professional summary

A professional summary on a resume typically spans three to four sentences and highlights your experience, skills, and achievements. It’s ideal for experienced applicants eager to show their professional identity and the value they bring to a role. For example, a loan officer might emphasize years of lending experience, customer service skills, and success in helping clients secure loans.

When crafting your resume, you can choose between writing a professional summary or an objective statement, each serving different needs. A resume objective focuses more on career goals. It’s ideal for entry-level applicants, those changing careers, or individuals with gaps in their work history. Essentially, it’s comparing “what I’ve accomplished” with “what I aim to contribute.”

We’ll provide examples of both summaries and objectives tailored for various industries and levels of experience. See our library of resume examples for additional inspiration.

Loan officer resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in finance and a minor in economics, eager to begin a career as a loan officer. Completed an internship at a local credit union where skills in financial analysis, customer service, and loan documentation were developed. Certified in Microsoft Excel and QuickBooks, with a keen interest in helping clients navigate their financial options.

Mid-career

Detail-oriented loan officer with over seven years of experience in the banking industry. Proven track record of evaluating loan applications, determining creditworthiness, and managing customer relationships. Successfully increased loan approval rates by 15% through effective risk assessment strategies. Known for excellent negotiation skills and maintaining strong client rapport.

Experienced

Seasoned loan officer specializing in commercial lending with more than 15 years in the financial sector. Expertise in structuring complex loans, leading cross-functional teams, and implementing strategic initiatives that led to a 20% growth in the commercial loan portfolio over three years. Recognized for leadership abilities and commitment to fostering long-term client partnerships.

Loan officer resume objective examples

Entry-level

Detail-oriented and driven individual with a bachelor’s degree in finance seeking an entry-level loan officer position. Eager to use strong analytical skills and customer service experience to assist clients in navigating the loan application process while contributing to the team’s success.

Career changer

Customer-focused retail manager transitioning into the loan officer field, bringing excellent communication skills and a proven ability to build client relationships. Looking forward to applying sales expertise and financial acumen to guide clients through their mortgage journey in a supportive banking environment.

Recent graduate

Ambitious recent finance graduate with internship experience at a local bank seeking a loan officer role. Committed to delivering exceptional client support and leveraging knowledge of lending practices to facilitate successful loan origination and approval processes.

Stand out in your loan officer job search! Our Resume Builder offers easy-to-use templates and tips to highlight your skills and experience.

Match your resume to the job description

Tailoring your resume to job descriptions is important because it helps you stand out to employers and get past applicant tracking systems (ATS). These systems scan for specific keywords from the job posting. By taking time to customize your resume, you ensure it aligns closely with what the employer is looking for, boosting your chances of landing an interview.

An ATS-friendly resume uses keywords from the job description. By incorporating these words and phrases, you show that your skills match what the employer needs, increasing the likelihood that hiring managers will notice your application and consider you for the role.

To find important keywords in a job posting, pay attention to repeated skills, qualifications, and duties. For example, if you’re applying for a loan officer position, look for terms like “loan origination,” “client interaction,” or “financial analysis.”

Incorporate these terms naturally into your resume by rephrasing your experiences. Instead of writing “Handled loan processing,” say “Managed loan origination processes to improve client satisfaction.” This makes your experience relevant and shows how you’ve applied similar skills in past roles.

Targeted resumes improve ATS compatibility by aligning with what employers seek. They not only help you pass initial screenings but also demonstrate that you’re a well-suited applicant for the job at hand.

Make your resume shine! Get quick feedback with our ATS Resume Checker to help get past hiring software and catch the eye of recruiters.

Salary Insights for Loan Officers

Understanding salary information can help you make informed decisions about your career path or even relocating to a new area. Researching pay trends in your field can give you a clearer picture of your options and goals.

Top 10 highest-paying states for loan officers

Loan Officers earn varying salaries across the United States, with a national average of $85,918. The table below highlights the states where loan officers command the highest compensation.

Our salary information comes from the U.S. Bureau of Labor Statistics’ Occupational Employment and Wage Statistics survey. This official government data provides the most comprehensive and reliable salary information for writers across all 50 states and the District of Columbia. The figures presented here reflect the May 2025 dataset, which is the most recent available as of this publication.

| State | Average Salary |

|---|---|

| District of Columbia | $155,220 |

| New York | $122,170 |

| Massachusetts | $109,310 |

| New Jersey | $100,160 |

| Vermont | $100,750 |

| New Hampshire | $97,290 |

| Connecticut | $96,460 |

| Minnesota | $96,180 |

| Virginia | $95,510 |

| California | $94,870 |

FAQ

Do I need to include a cover letter with my loan officer resume?

Yes, including a cover letter with your loan officer resume can boost your application and help you stand out from other applicants. A cover letter lets you explain why you’re interested in the role and how your skills align with the company’s lending goals or customer service priorities.

For instance, if the institution specializes in home loans or small business financing, you can tailor your cover letter to emphasize experience in those areas. Check out these cover letter examples for inspiration.

You can also share insights into your ability to build relationships with clients, assess financial qualifications, and meet lending targets effectively. Consider using our Cover Letter Generator to structure your letter professionally while keeping it specific to the position and company values.

How long should a loan officer’s resume be?

For a loan officer, aim for a one-page resume to effectively highlight key skills like financial analysis, customer service, and familiarity with loan management software.

If you have extensive experience or specialized certifications that add significant value, extending to a two-page resume is acceptable. Just ensure each detail is directly relevant, focusing on your ability to assess borrower credibility and manage loan processes efficiently.

To fine-tune your resume length based on your career stage, explore our guide on how long a resume should be for more examples and tips.

How do you write a loan officer resume with no experience?

When you’re starting out as a loan officer without any experience, it’s key to tailor your resume with no experience to highlight the skills and education that demonstrate your potential for success in this role. Here are a few tips:

- Highlight relevant education: Begin with your degree in finance, economics, or business, if applicable. Include any coursework or projects related to lending, credit analysis, or financial services.

- Showcase transferable skills: Emphasize skills like communication, customer service, negotiation, and problem-solving. Detail any experience where you’ve demonstrated these abilities, such as previous jobs or volunteer roles.

- Include internships or externships: If you’ve had an internship in a bank or financial institution, describe the tasks you handled and what you learned about loan processes and customer interactions.

- Certifications and training: Mention any relevant certifications, like a mortgage loan originator license (MLO) or training programs that relate to lending practices or financial management.

- Use a strong summary statement: Write a brief summary at the top of your resume that highlights your enthusiasm for entering the field of banking and finance.

Remember to tailor each section of your resume to reflect how you can meet the needs of a potential employer in the loan industry.

Rate this article

Loan Officer

Additional Resources

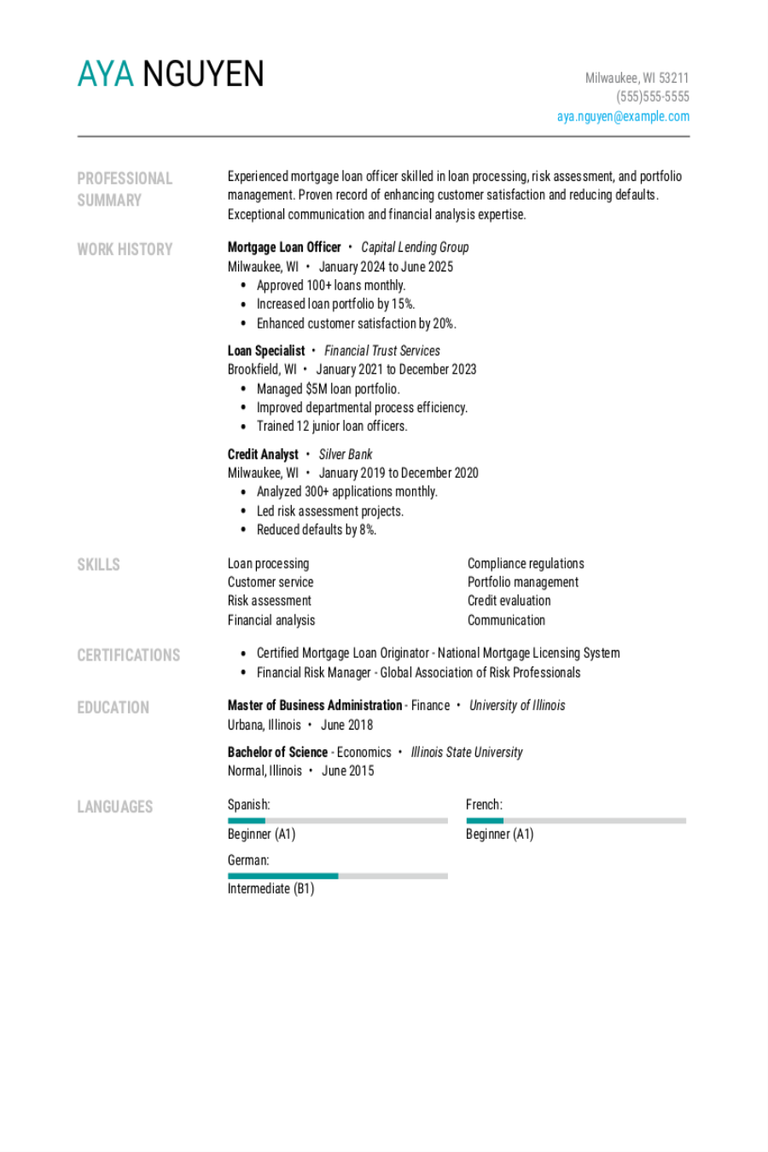

Mortgage Loan Officer Resume Examples & Templates for 2025

A mortgage loan officer educates, counsels and guides potential borrowers on choosing mortgage products, and helps them complete loan application processes. In this role, you’ll be expected to build and

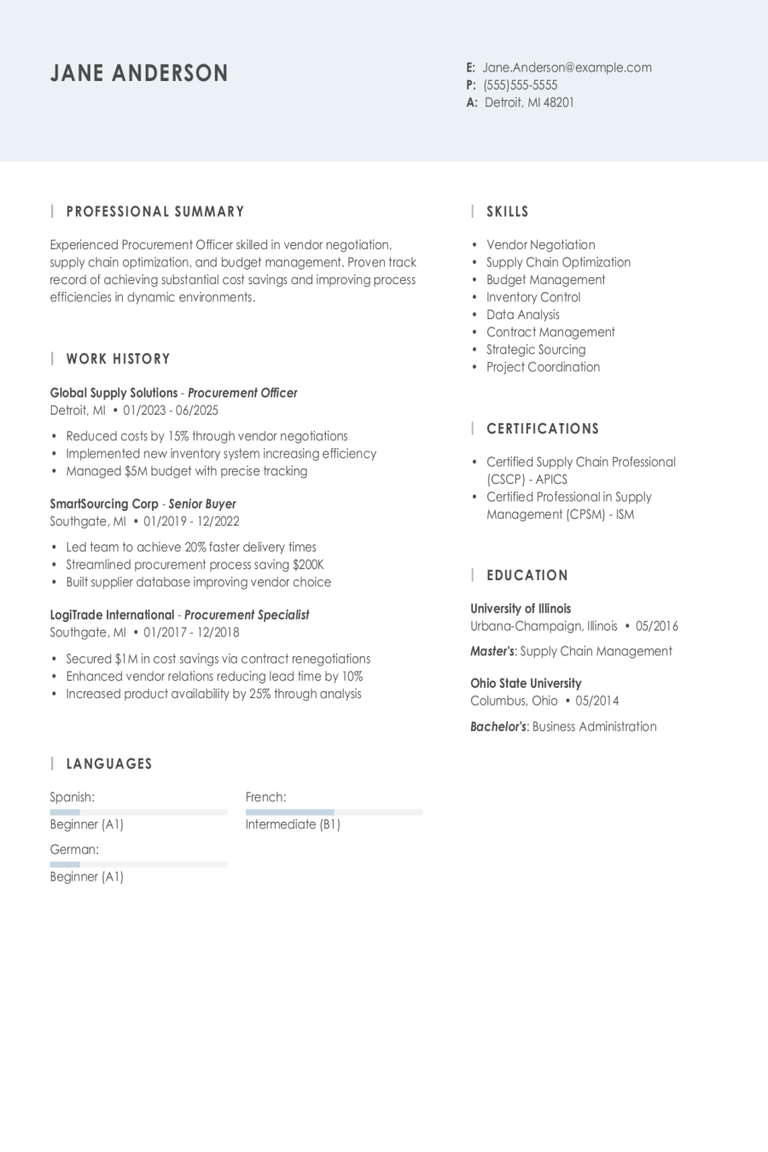

Procurement Officer Resume Examples & Templates for 2025

Advance in your career with a well-written procurement officer Resume. Our guide can help you create an effective procurement officer Resume to showcase your skills and present you as a

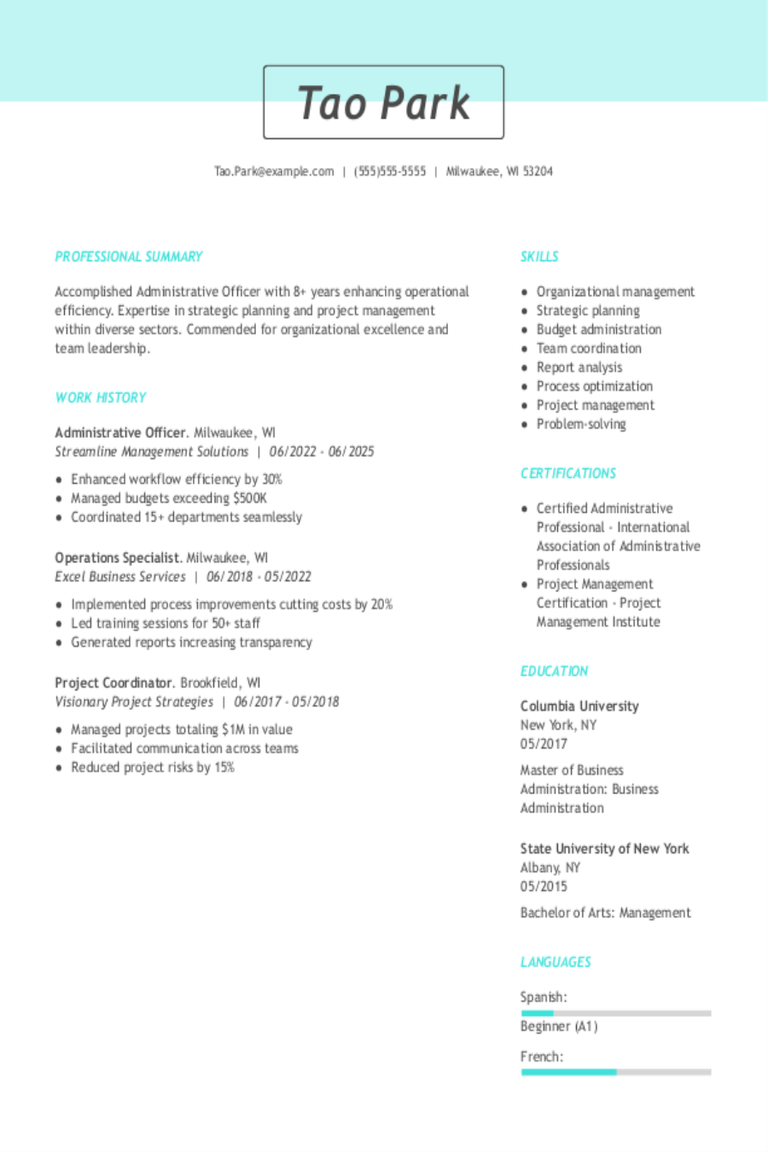

Administrative Officer Resume Examples & Templates for 2025

Improve your administrative officer resume resume by using our professionally written administrative officer resume summary, skills and work experience examples. Plus, learn the do’s and don’ts, and get your top

Public Relations Officer Resume Examples & Templates

Propel your career with an effective public relations officer Resume. Use this guide with writing tips and samples to craft an excellent public relations officer Resume that’ll showcase your creativity

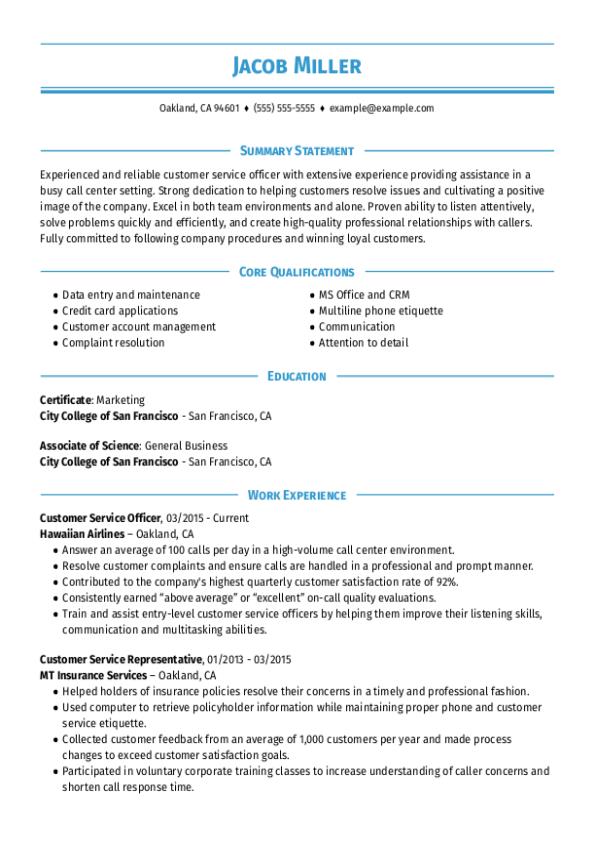

Customer Service Officer Resume Examples & Templates

Entry-level

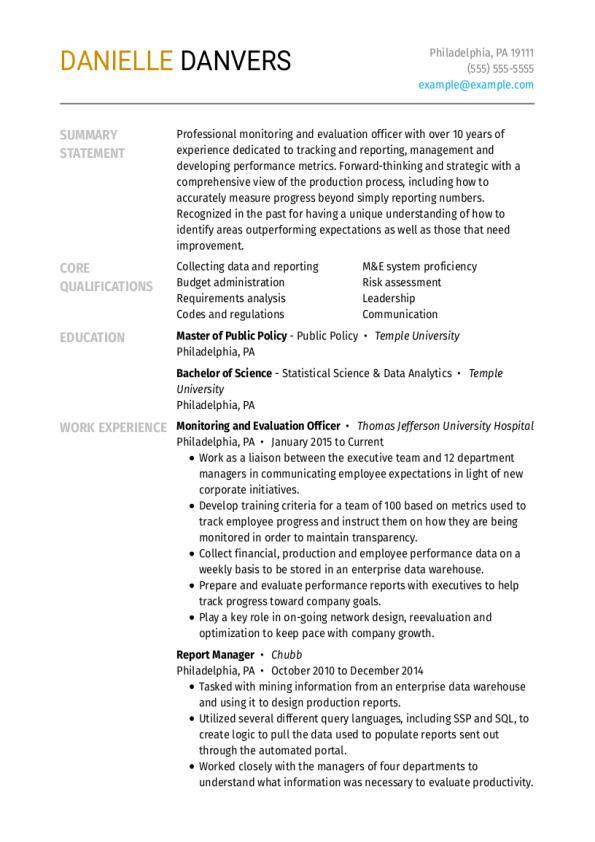

Monitoring & Evaluation Officer Resume Guide + Tips + Example

A well-written Resume is a great place to start on your path to a monitoring and evaluation officer job, and we’re here to help you create one. Our guide to