Why this resume works

- Quantifies accomplishments: By reducing defaults by 20% and analyzing over 100 credit applications monthly, the applicant provides concrete examples of their measurable impact.

- Showcases career progression: Starting as a financial risk advisor and advancing to a credit risk analyst shows the applicant’s career growth through progressively responsible roles in risk management.

- Uses action-oriented language: Action verbs like “developed,” “implemented,” and “advised” convey initiative and effectiveness.

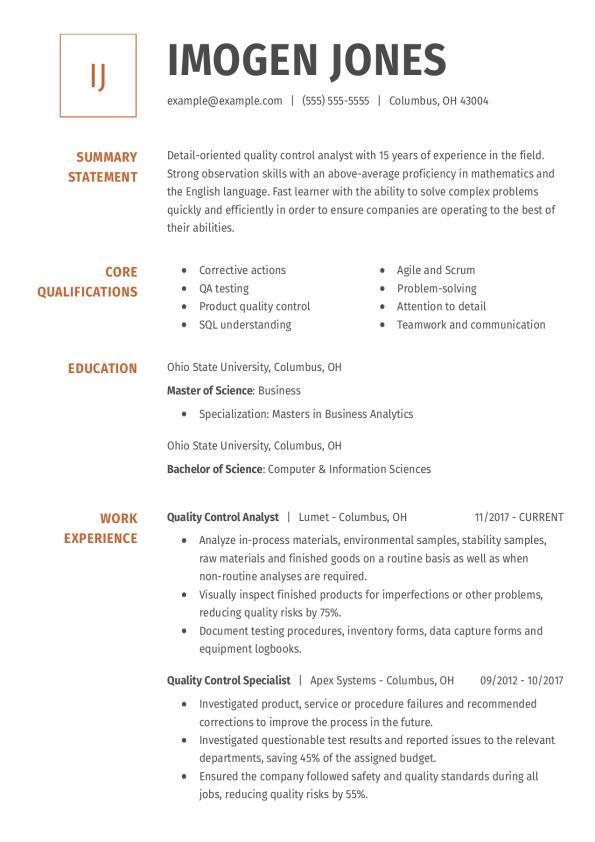

More Credit Risk Analyst Resume Examples

Browse our credit risk analyst resume examples to discover how to highlight your analytical skills, financial expertise, and decision-making abilities. These finance resume samples will help you craft a resume that attracts top employers in finance.

Entry-Level Credit Risk Analyst

Why this resume works

- Effective use of keywords: By weaving in role-specific keywords like “credit risk analyst” and “financial modeling”, the applicant ensures their resume navigates applicant tracking systems (ATS) effectively, boosting visibility in credit risk roles.

- Centers on academic background: The education section spotlights a Master’s degree in credit risk analysis, showcasing a strong foundation important for early career growth in finance.

- Puts skills at the forefront: Using a skills-based resume format, the applicant places skills such as financial modeling and data analytics front and center, improving entry-level appeal.

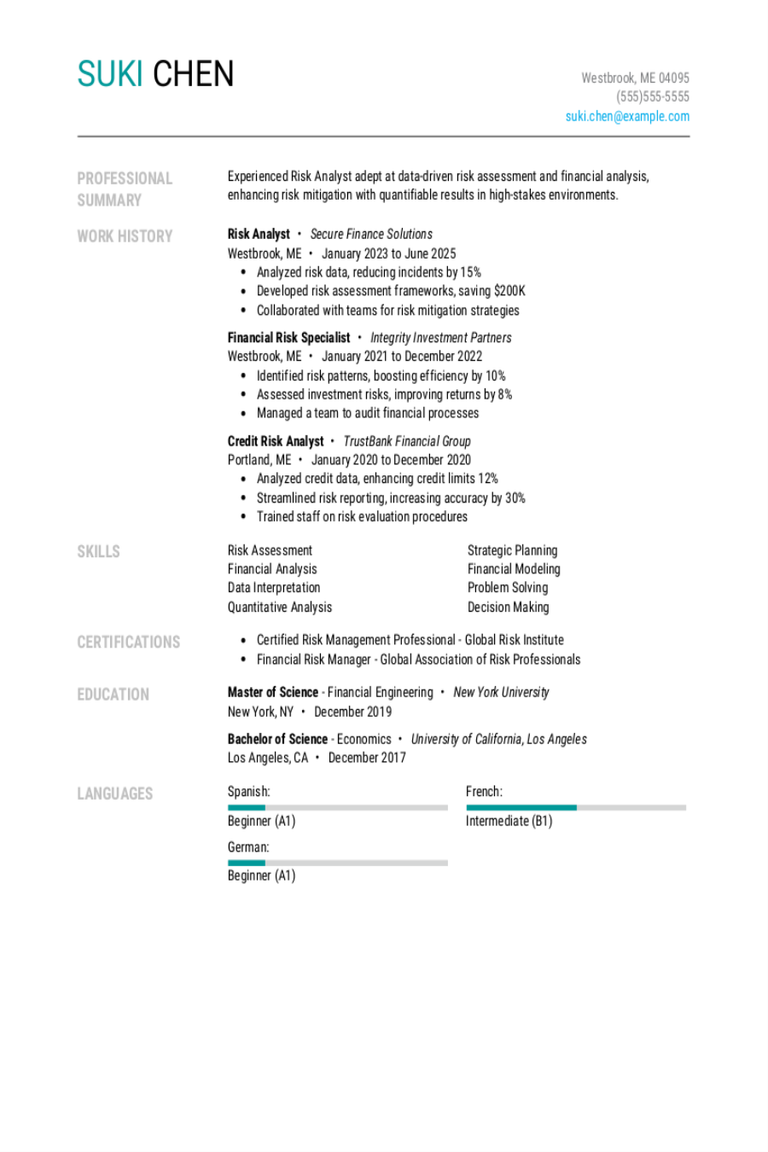

Mid-Level Credit Risk Analyst

Why this resume works

- Points to measurable outcomes: With achievements like reducing portfolio risks by 15%, the applicant effectively showcases a results-driven approach and ability to deliver measurable financial improvements.

- Maximizes readability: The effective use of white space and clear resume sections helps ATS and recruiters quickly scan the resume.

- Demonstrates language abilities: Knowledge in Spanish, French, and Chinese highlight strong language skills, improving cross-cultural communication capabilities essential for international finance roles.

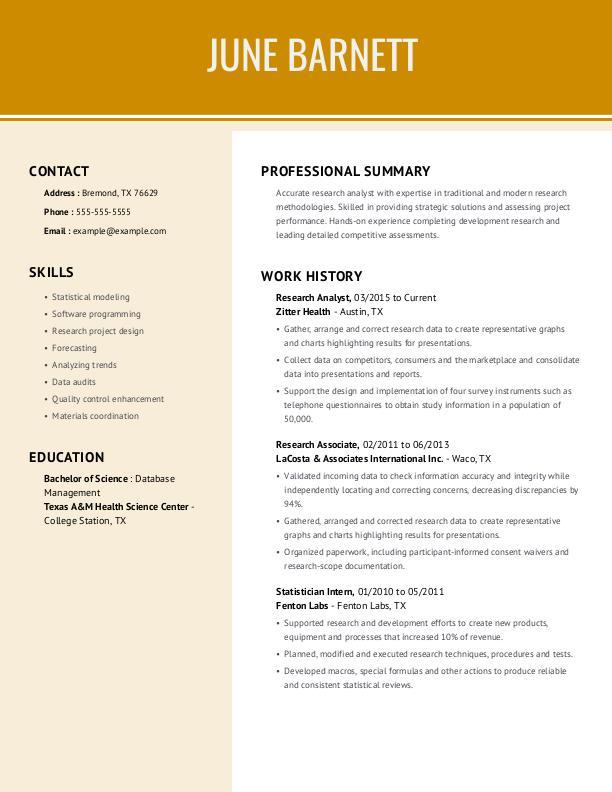

Experienced Credit Risk Analyst

Why this resume works

- Showcases impressive accomplishments: By showcasing achievements like reducing defaults by 12% and saving $2M, the applicant’s accomplishments reflect impactful contributions to financial risk management.

- Focuses on work history: The applicant uses a chronological resume format to effectively highlight extensive experience in credit risk analysis and risk management over 15 years.

- Emphasizes leadership skills: Taking charge of team training initiatives and developing scoring models, the applicant’s leadership skills are evident throughout their roles in finance.

Credit Risk Analyst Resume Template (Text Version)

Olivia Patel

Lakeside, CA 92052

(555)555-5555

Olivia.Patel@example.com

Professional Summary

Experienced Credit Risk Analyst skilled in developing models and analyzing metrics to reduce financial risks. Proven track record in implementing policies, enhancing productivity by 15%, and advising to improve credit scores by 25%.

Work History

Credit Risk Analyst

Financial Insights Inc. – Lakeside, CA

July 2023 – July 2025

- Developed risk models, reducing defaults by 20%

- Analyzed 100+ credit applications monthly

- Collaborated with teams to enhance risk metrics

Risk Assessment Specialist

ProBank Solutions – Riverside, CA

July 2020 – June 2023

- Implemented new risk policies, boosting efficiency by 15%

- Evaluated 150+ corporate accounts annually

- Led risk workshops increasing team skillset

Financial Risk Advisor

SecureFinance Group – Riverside, CA

July 2019 – June 2020

- Advised clients, improving credit scores by 25%

- Monitored risk metrics for 0M in assets

- Streamlined processes saving 10% in costs

Skills

- Credit Risk Analysis

- Financial Modeling

- Data Analysis

- Risk Management

- Problem Solving

- Statistical Analysis

- Fraud Detection

- Regulatory Compliance

Education

Master of Science Finance

University of Pennsylvania Philadelphia, PA

June 2019

Bachelor of Science Economics

New York University New York, NY

June 2017

Certifications

- Certified Risk Management Professional – Risk Management Association

- Chartered Financial Analyst (Level 1) – CFA Institute

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Related Resume Guides

- Equity Research Analyst

- Estimation Engineer

- Financial Advisor

- Financial Analyst

- Financial Consultant

- Financial Project Manager

- Forex Trader

- Fund Manager

- Investment Banker

- KYC Analyst

- Personal Banker

- Project Assistant

- Strategic Planning

- Tax Accountant

- Tax Consultant

- Tax Manager

- Tax Preparer

- Treasury Accountant

- Treasury Manager

- Venture Capital Analyst

Advice for Writing Your Credit Risk Analyst Resume

Explore our tips on how to write a resume for a credit risk analyst position and learn how to highlight your analytical skills, financial expertise, and ability to assess credit risk.

Highlight your most relevant skills

Listing relevant skills when applying for a job like credit risk analyst is key to standing out. Employers want to know you have the right mix of abilities for the role. A dedicated skills section in your resume helps show this clearly.

It should include technical skills, like data analysis and financial modeling, alongside interpersonal skills, such as communication and teamwork. Balancing both types gives a fuller picture of who you are and how you’ll fit into their team.

To make your resume even stronger, weave these key skills into your work experience section. For example, if you’ve used data analysis in past jobs to improve decision-making or worked with teams to address risk issues, highlight those experiences.

This not only shows that you possess the skills but also that you’ve successfully applied them before. By doing this, employers can easily see you’re prepared for the demands of being a credit risk analyst.

When crafting your resume, aim for clear language that’s easy to understand. Showcasing your skills effectively helps employers quickly grasp why you’re a great match for the credit risk analyst position. Keep it simple yet impactful by focusing on what’s most relevant and demonstrating how you’ve used those skills in real-world situations.

Showcase your analytical skills, attention to detail, and financial expertise by using a resume format tailored for credit risk analysts.

Showcase your accomplishments

When organizing your work experience as a credit risk analyst, list jobs in reverse order, starting with the most recent. Each entry should have your job title, employer name, location, and employment dates. This setup helps hiring managers easily follow your career progress.

Instead of just listing duties, focus on quantifying accomplishments to make your resume stand out. For example, mention how you reduced default rates by a certain percentage or improved assessment efficiency by specific time savings.

Turning duties into achievements means showing measurable results. Use numbers like percentages for risk reduction or cost savings to highlight your impact. Action-oriented words like “implemented,” “analyzed,” or “optimized” can effectively describe what you did and achieved in each role. By quantifying accomplishments, you allow hiring managers to quickly see the skills and value you bring to the table.

Quantified achievements are key because they show real impact rather than vague responsibilities. They give employers a clear picture of how you’ve contributed to business goals in past roles as a credit risk analyst. Focus on core duties but always aim to express them through measurable outcomes that demonstrate your ability to add value and drive results in any position you hold.

5 credit risk analyst work history bullet points

- Analyzed and assessed risk for a $500 million portfolio, reducing default rates by 15% through strategic adjustments.

- Developed and implemented credit risk models, improving accuracy of forecasts by 20% and improving decision-making processes.

- Collaborated with cross-functional teams to streamline credit approval processes, cutting processing time by 30%.

- Led efforts in identifying high-risk accounts, resulting in a 25% reduction in delinquency within the first year.

- Conducted comprehensive market research and analysis, providing insights that increased portfolio profitability by 10%.

Choose a resume template that’s straightforward and easy to read. Opt for clear headings and simple fonts, avoiding elaborate designs that might distract from showcasing your skills.

Write a strong professional summary

A professional summary on a resume serves as an introduction to hiring managers, helping them quickly assess your qualifications. It’s best for experienced applicants. It includes three to four sentences showcasing your experience, skills, and achievements. Its purpose is to highlight your professional identity and the value you bring to the employer.

Resume objectives are statements of career goals and are ideal for entry-level job seekers, career changers, or those with employment gaps. Unlike summaries that focus on past accomplishments, objectives emphasize what you aim to contribute in the future.

Next, we’ll provide examples of both summaries and objectives tailored to different industries and levels of experience.

Credit risk analyst resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in finance and a focus on risk management. Completed an internship at ABC Bank, assisting in the evaluation of credit applications and learning risk assessment techniques. Holds CFA Level I certification and familiar with financial modeling tools such as Excel and SAS. Eager to contribute analytical skills to support effective credit risk strategies.

Mid-career

Credit risk analyst with over five years of experience in corporate banking environments. Proven track record in analyzing creditworthiness, preparing detailed risk reports, and advising on loan approval processes. Expertise in using Moody’s Analytics software for risk assessment and well-versed in regulatory compliance frameworks like Basel III. Recognized for developing efficient risk models that improve decision-making processes.

Experienced

Senior credit risk analyst specializing in complex financial products and portfolio management with 10+ years of experience. Strong leadership capabilities demonstrated by leading cross-functional teams to optimize credit policies and procedures, resulting in significant reduction of default rates. Advanced knowledge of quantitative analysis techniques and certified FRM (Financial Risk Manager). Committed to driving strategic initiatives that balance growth objectives with prudent risk management.

Credit risk analyst resume objective examples

Recent graduate

Detail-oriented recent graduate with a bachelor’s degree in finance and coursework in credit risk analysis eager to begin a career as a credit risk analyst. Looking to apply academic knowledge of financial modeling and data analysis to assess and mitigate risks for dynamic financial institutions.

Career changer

Analytical professional transitioning from customer service into credit risk analysis, bringing strong problem-solving skills and experience interpreting financial data. Aiming to contribute to a team’s success by leveraging transferable skills along with newly acquired training in risk assessment techniques.

Entry-level applicant

Aspiring credit risk analyst with hands-on internship experience in financial reporting and skill in using tools like Excel and SQL. Eager to support organizational goals by identifying potential risks and implementing effective mitigation strategies within fast-paced environments.

Highlight your skills as a credit risk analyst with our Resume Builder. Choose a template, fill in your details, and get a professional-looking resume fast!

Match your resume to the job description

Tailoring resumes to job descriptions is essential because it helps job seekers stand out to employers and pass through ATS. Many companies use ATS to scan for specific keywords and phrases that match the job posting. If your resume includes these keywords, you have a better chance of getting noticed by hiring managers.

An ATS-friendly resume contains keywords and phrases that align with your skills and experience. When your resume matches the language used in the job description, it shows that you have what the employer is looking for. This can increase your chances of being selected for an interview.

To identify keywords from job postings, look closely at the skills, qualifications, and duties mentioned repeatedly. For example, a credit risk analyst job might list “data analysis,” “risk assessment,’ or “financial modeling” as key responsibilities. Using exact phrases from the posting can help your resume get picked up by ATS.

Incorporate these terms naturally into your resume content. Instead of copying phrases directly, rewrite them to fit your experience. For example, if the job description says “conduct thorough risk assessments,” you could write “conducted thorough risk assessments to identify potential financial risks.”

Targeted resumes improve ATS compatibility by making sure they contain relevant keywords that employers are searching for. By taking time to customize your resume for each job description, you increase your chances of passing through ATS and landing an interview.

Make sure your resume stands out! Try our ATS Resume Checker to find any formatting problems, missing keywords, or other issues before you send it in.

FAQ

Do I need to include a cover letter with my credit risk analyst resume?

Yes, including a cover letter with your credit risk analyst resume is a smart move.

It gives you the opportunity to explain why you’re specifically interested in the company and role while highlighting your analytical skills and experience in assessing credit risks.

For instance, if the company focuses on certain industries or markets you’re experienced in, you can detail your expertise and how it aligns with their needs.

Consider using tools like the Cover Letter Generator to help craft a compelling cover letter that complements your resume by emphasizing key achievements or projects relevant to credit risk analysis.

Additionally, reviewing cover letter examples can provide inspiration and guidance for tailoring yours effectively.

How long should a credit risk analyst’s resume be?

For a credit risk analyst, aim for a one-page resume to effectively highlight your analytical skills, familiarity with risk assessment tools, and experience in financial analysis. This length helps keep the focus on key achievements and competencies without overwhelming the reader.

If you have extensive experience or specialized qualifications that are highly relevant to this field, extending to a two-page resume is acceptable. Just ensure each section adds value by demonstrating your expertise in evaluating credit risk and contributing to financial decision-making processes.

Explore our guide on how long a resume should be for tips on tailoring your resume length based on your career stage.

How do you write a credit risk analyst resume with no experience?

Creating a credit risk analyst resume when you lack direct experience means focusing on your skills, education, and any relevant experiences that show your potential for the job. For guidance, check out these tips on writing a resume with no experience:

- Emphasize relevant coursework: List courses such as finance, economics, statistics, or data analysis that relate directly to credit risk analysis. Mention projects or case studies where you applied these concepts.

- Highlight transferable skills: Focus on analytical skills, problem-solving abilities, and attention to detail. If you’ve done research projects or data analysis in school or personal projects, detail those experiences.

- Leverage internships and volunteer work: Even if not directly related to credit risk analysis, any experience involving financial services or data management can be valuable. Describe tasks that involved analyzing information or assessing risks.

- Showcase technical skill: Skill in tools like Excel, SQL, SAS, or Python is important in this field. Include any certifications or self-taught skills relevant to data handling and financial modeling.

Rate this article

Credit Risk Analyst

Additional Resources

Risk Analyst Resume Examples & Templates for 2025

Discover how risk analysts showcase their problem-solving skills and attention to detail. These resume examples and tips help you highlight your ability to identify potential risks and create effective solutions.Build

Quality Control Analyst Resume Guide + Tips + Example

Propel your career with a well-written quality analyst Resume. With our guide, you can create a professional quality analyst Resume to showcase your skills and present you as a desirable

Data Analyst Resume Examples & Templates

Data analysts are experts in processing and presenting data in ways that help organizations and companies. Beyond your excellent database knowledge and data visualization expertise, your data analyst resume must

Research analyst Resume Guide + Tips + Example

Advance your research analyst career with a strong resume. We have the perfect guide to help you, with tips on what to add, skills to include, and how using a

Operations Analyst Resume Guide + Tips + Example

Get the analyst job you want with a professional operations analyst resume. With our guidance, you can create an effective operations analyst resume to showcase your relationship-building skills, statistical analysis

Reporting Analyst Resume Examples & Templates

Reporting analysts contribute to organizational improvement through gathering and analyzing data, preparing reports and introducing process improvements through the reporting process. On this page, we’ll provide you with expert tips to