Why this resume works

- Quantifies accomplishments: Quantifies accomplishments by providing specific metrics, such as managing payroll for 500+ employees with 100% accuracy and reducing payroll errors by 25%.

- Showcases career progression: Showcases career progression by showcasing the job seeker’s advancement from payroll associate to payroll specialist, each with increasing responsibilities and larger employee groups.

- Uses action-oriented language: Action-oriented language like “managed,” “reduced,” and “implemented” clearly indicates the job seeker’s proactive contributions in previous roles.

More Payroll Specialist Resume Examples

Take a look at our payroll specialist resume examples to learn how to highlight your payroll management skills, attention to detail, and compliance knowledge. These billing and collections resume samples will help you build a resume that attracts potential employers.

Entry-level Payroll Specialist

Why this resume works

- Features education section: The education section stands out by clearly detailing degrees and emphasizing academic achievements crucial for entry-level candidates.

- Touches on accomplishments: Accomplishments like reducing processing time by 20% demonstrate the job seeker’s exceptional performance and contributions in their roles.

- Effective use of keywords: Keywords such as ‘payroll management,’ ‘compliance,’ and ‘process optimization’ are strategically included to pass Applicant Tracking Systems effectively.

Mid-level Payroll Specialist

Why this resume works

- Hones in on real impact: Showcases measurable impact by detailing payroll error reduction and cost-saving implementations, highlighting tangible benefits to previous employers.

- Demonstrates language abilities: Language skills are evident through fluency in Spanish and intermediate French, highlighting the potential for cross-cultural communication and international project collaboration.

- Displays technical expertise: Displays technical expertise by listing specialized skills like tax compliance, payroll software proficiency, and certifications such as Certified Payroll Professional.

Experienced Payroll Specialist

Why this resume works

- Lists relevant certifications: The resume clearly lists certifications like CPP, reflecting the job seeker’s commitment to continued learning and expertise in payroll management.

- Showcases impressive accomplishments: Significant achievements such as reducing payroll errors by 15% and boosting efficiency by 20% highlight the job seeker’s impactful contributions at a senior level.

- Focuses on work history: The chronological resume format emphasizes an extensive work history, ideal for showcasing over a decade of progressive experience in payroll roles.

Payroll Specialist Resume Template (Text Version)

Victoria Gray

Spokane, WA 99203

(555)555-5555

Victoria.Gray@example.com

Professional Summary

Dedicated payroll specialist with 5 years of experience in payroll management. Expert in tax compliance, accuracy, and system optimization. Proven track record of enhancing payroll efficiency and reducing errors.

Skills

- Payroll Management

- Tax Compliance

- HR Coordination

- Accounting Software

- Data Analysis

- Attention to Detail

- Time Management

- Problem Solving

Certifications

- Certified Payroll Professional (CPP) – American Payroll Association

- Certified Public Accountant (CPA) – Texas State Board of Public Accountancy

Education

Master’s Degree Accounting

University of Texas Austin, Texas

May 2019

Bachelor’s Degree Finance

Southern Methodist University Dallas, Texas

May 2017

Work History

Payroll Specialist

Corporate Solutions Inc. – Spokane, WA

January 2023 – March 2025

- Managed payroll for 500+ employees with 100% accuracy

- Reduced payroll errors by 25% through software optimization

- Processed tax filings and compliance reports on time

Payroll Administrator

Global Tech Services – Tacoma, WA

January 2021 – December 2022

- Oversaw payroll processing for 300+ employees monthly

- Implemented payroll system improvements, cutting time by 20%

- Ensured payroll tax compliance, avoiding penalties

Payroll Associate

Innovative Solutions Co. – Seattle, WA

January 2020 – December 2020

- Assisted in payroll processing for 150 employees weekly

- Reconciled payroll accounts, improving accuracy by 15%

- Coordinated with HR for employee records updates

Languages

- English – Beginner (A1)

- Spanish – Beginner (A1)

- French – Beginner (A1)

Popular Skills for a Payroll Specialist Resume

A well-organized resume skills section is essential for highlighting the technical expertise and soft skills required to succeed as a payroll specialist. This position requires precision with numbers and software, along with effective communication and problem-solving abilities.

Below are a few of the top soft skills frequently listed on payroll specialist resumes.

| Soft Skills | % of resumes with this skill |

|---|---|

| Telephone and email etiquette | 26.32% |

| Meeting deadlines | 22.08% |

| Excellent writing skills | 20.00% |

| Interpersonal and written communication | 18.75% |

| Organizational skills | 17.95% |

Here are a few examples of hard skills frequently included on payroll specialist resumes.

| Hard Skills | % of resumes with this skill |

|---|---|

| Payroll processing | 51.35% |

| Time sheet review | 43.42% |

| Payroll administration | 40.00% |

| ADP | 31.25% |

| Spreadsheet creation | 24.53% |

Related Resume Guides

Advice for Writing Your Payroll Specialist Resume

Discover essential tips on how to write a resume for a payroll specialist position and learn how to highlight your expertise in managing payroll processes, compliance, and employee satisfaction.

Highlight your most relevant skills

Listing relevant skills when applying for a payroll specialist job is key to showing employers you have what it takes to succeed in the role. A dedicated skills section helps them quickly see your qualifications. Make sure to balance technical skills, like payroll software proficiency and tax knowledge, with interpersonal skills, such as attention to detail and teamwork.

To make your resume stand out, integrate these key skills into your work experience section. For example, if you managed payroll for a large company using specific software, mention that. Or if you resolved payroll discrepancies through effective communication, highlight this too. This approach not only shows what you can do but also how you’ve applied these skills in real situations.

When listing your skills, use bullet points for clarity and keep descriptions brief yet specific. Group similar skills together and prioritize the most relevant ones at the top of the list. This method ensures that hiring managers can easily see your capabilities and understand how they align with the payroll specialist role.

To get past ATS and catch recruiters’ eyes, add relevant keywords from the job posting into your resume.

Showcase your accomplishments

When listing your work experience as a payroll specialist, start with your most recent job and work backward. Each entry should include your job title, employer name, location, and the dates you worked there. This reverse chronological order helps employers quickly see your career progression.

Make sure to highlight your accomplishments by including measurable results. Instead of listing duties like “processed payroll,” turn them into achievements such as “processed bi-weekly payroll for 300 employees, reducing errors by 15%.” Use numbers to show impact — percentages, time savings, cost reductions, or efficiency improvements make your resume stand out.

Use action verbs that focus on what you achieved. Words like “increased,” “decreased,” “implemented,” and “streamlined” are powerful. Quantified accomplishments help hiring managers see the value you bring.

For example, say, “reduced payroll processing time by 20% through new software implementation.” This way, they can easily understand your skills and what you can do for their company.

5 payroll specialist work history bullet points

- Processed bi-weekly payroll for a workforce of 500+ employees, ensuring 99.9% accuracy and timely disbursements.

- Implemented a new payroll software system that reduced processing time by 25% and decreased errors by 15%.

- Conducted regular audits and reconciliations of payroll accounts, identifying and correcting discrepancies to prevent overpayments and underpayments.

- Collaborated with HR to streamline the onboarding process, resulting in a 20% reduction in the time taken to set up new hires in the payroll system.

- Developed comprehensive reports for management on payroll costs, overtime, and benefits utilization, aiding in budget forecasting and financial planning.

Opt for a straightforward resume template with well-defined sections, steering clear of elaborate fonts and excessive colors to ensure your skills and experience are easily readable.

Write a strong professional summary

A professional summary is a short statement at the top of your resume highlighting your main skills and experiences. For a payroll specialist, this summary should demonstrate your expertise in payroll processing, attention to detail, and knowledge of tax regulations, helping employers quickly grasp your value and make a strong first impression.

If you have extensive experience as a payroll specialist, use a professional summary to showcase your achievements and specific skills, such as improving payroll accuracy or reducing processing time. If you’re new to the field, opt for a resume objective instead. Highlight your eagerness to learn alongside any relevant coursework or internships.

Describe your impact using action words like “managed,” “improved,” or “implemented.” Organize this section by starting with your most impressive achievement or skill and tailor it specifically to the job by mentioning key skills listed in the job posting.

Payroll specialist resume summary examples

Entry-level

Recent graduate with a bachelor’s degree in accounting and certification in payroll fundamentals. Proficient in payroll software such as ADP and QuickBooks, and skilled in data entry, payroll processing, and basic tax regulations. Eager to apply strong analytical skills and attention to detail in an entry-level payroll specialist role.

Mid-career

Experienced payroll specialist with over 5 years of expertise in managing payroll operations for mid-sized companies. Proficient in multi-state payroll processing, compliance with federal and state regulations, and managing benefits administration. Known for improving payroll accuracy through process improvements and exceptional problem-solving abilities.

Experienced

Seasoned payroll specialist with 10+ years of comprehensive experience overseeing payroll functions for large organizations. Demonstrated leadership in implementing advanced payroll systems, ensuring compliance with complex tax laws, and mentoring junior staff. Proven track record of reducing errors by 30% through meticulous audits and strategic process enhancements.

Payroll specialist resume objective examples

Recent graduate

Detail-oriented and highly motivated recent graduate with a degree in accounting seeking an entry-level payroll specialist position. Eager to apply strong analytical skills, proficiency in payroll software, and a comprehensive understanding of tax regulations to ensure accurate and timely payroll processing.

Career changer

Dedicated professional with a background in administrative support and finance transitioning into a payroll specialist role. Bringing excellent organizational skills, attention to detail, and a keen interest in payroll management to contribute effectively to the team while ensuring compliance and accuracy.

Specialized training

Recent human resources graduate with specialized coursework in payroll management seeking an entry-level payroll specialist position. Passionate about leveraging knowledge of HR practices, payroll systems, and data accuracy to support efficient payroll operations and enhance employee satisfaction.

Use our Resume Builder to create your payroll specialist resume. It helps you organize your skills and experience quickly with easy-to-use templates.

Match your resume to the job description

Customizing your resume to align with the job description is crucial as it demonstrates your suitability for the payroll specialist position. Employers and applicant tracking systems (ATS) seek specific words and phrases from the job posting within your resume, which can increase its visibility if those keywords are present.

To create an ATS-friendly resume, carefully review the job posting to identify key terms such as “payroll processing,” “tax compliance,” or “employee benefits.” Integrate these keywords into your resume accordingly.

For instance, if the job description highlights “processing payroll on time,” you might include a bullet point: “Processed payroll accurately and on time for over 200 employees each pay period.” See how to customize your resume for more tips and examples.

You can use our ATS Resume Checker to scan your resume against 30+ criteria and get actionable suggestions to improve your resume score.

FAQ

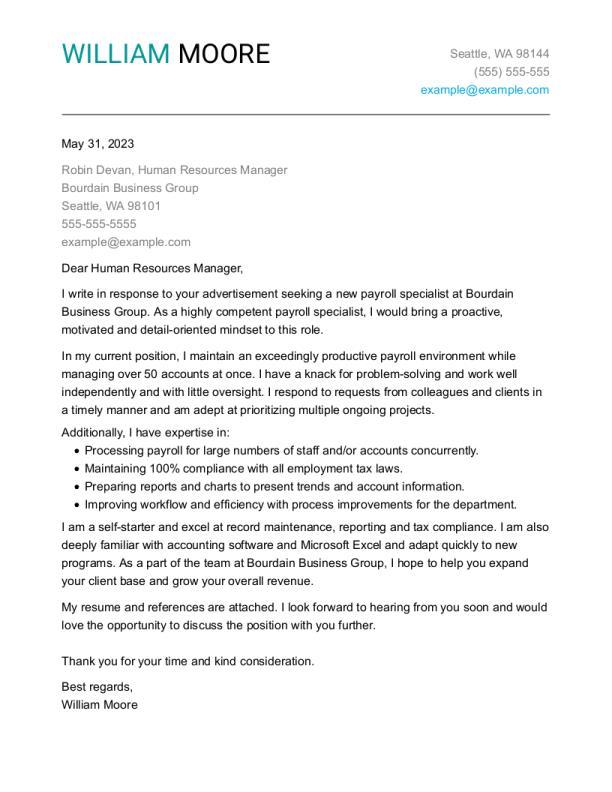

Do I need to include a cover letter with my payroll specialist resume?

A well-written cover letter can significantly strengthen your payroll specialist application. It provides an opportunity to highlight key achievements and experiences that may not be fully conveyed in your resume.

For example, you can elaborate on how you’ve implemented efficient payroll systems, ensured strict compliance with tax and labor regulations, or contributed to improving accuracy and timeliness in payroll operations.

A cover letter also allows you to express genuine interest in the organization and the role, demonstrating your alignment with their goals and values. Explore cover letter examples for additional inspiration and guidance.

Tailoring your letter to the specific job posting can further reinforce your suitability for the position. For guidance, explore payroll specialist cover letter examples or use our Cover Letter Generator to begin crafting your own.

How long should a payroll specialist’s resume be?

For a payroll specialist, a concise one-page resume is ideal for highlighting essential skills like proficiency with payroll software, attention to detail, and experience in payroll processing and compliance.

However, if you have significant experience or highly relevant specialized certifications, a two-page resume can be suitable. Ensure every included detail is pertinent, showcasing your efficiency in managing payroll operations and emphasizing recent and relevant roles to maintain interest.

Explore our guide on how long a resume should be for examples and tips on determining the ideal length for your career stage.

How do you write a payroll specialist resume with no experience?

Crafting a resume with no experience requires highlighting your skills, education, and any relevant activities. Here are a few tips to get started:

- Begin by emphasizing your education: Focus on degrees or coursework in finance, accounting, or business administration. Be sure to include any specific classes related to payroll processing or tax laws.

- Showcase transferable skills: Highlight transferable skills pertinent to the role of a payroll specialist, such as attention to detail, proficiency with spreadsheets or accounting software, data entry accuracy, and strong organizational abilities.

- Mention internships and volunteer work: Include any internships or volunteer roles that involved managing financial records or administrative tasks. Describe how these experiences enhanced your understanding of payroll processes.

- List certifications: If you’ve taken courses on platforms like Coursera or earned certifications such as Fundamental Payroll Certification (FPC), these demonstrate your dedication to learning about the field.

You can open your resume with a brief paragraph expressing your passion for the payroll field and outlining what you hope to achieve in this role.

Rate this article

Payroll Specialist

Additional Resources

Payroll Specialist Cover Letter Examples & Templates

A well-written resume can only take you so far. To truly stand out, complement it with a strong cover letter. Typically, a cover letter includes an introduction, a few body

Benefits Specialist Resume Examples & Templates

Benefits specialists manage employee compensation and benefits programs, including medical, vision, disability coverage, and 401(k) plans. This role calls for coordinating employee plans, researching and analyzing plan options, and communicating

5 Common HR Specialist Interview Questions & Answers

Once you have put in the time necessary to craft a resume and cover letter that will stand out from the crowd, and that hard work has resulted in you

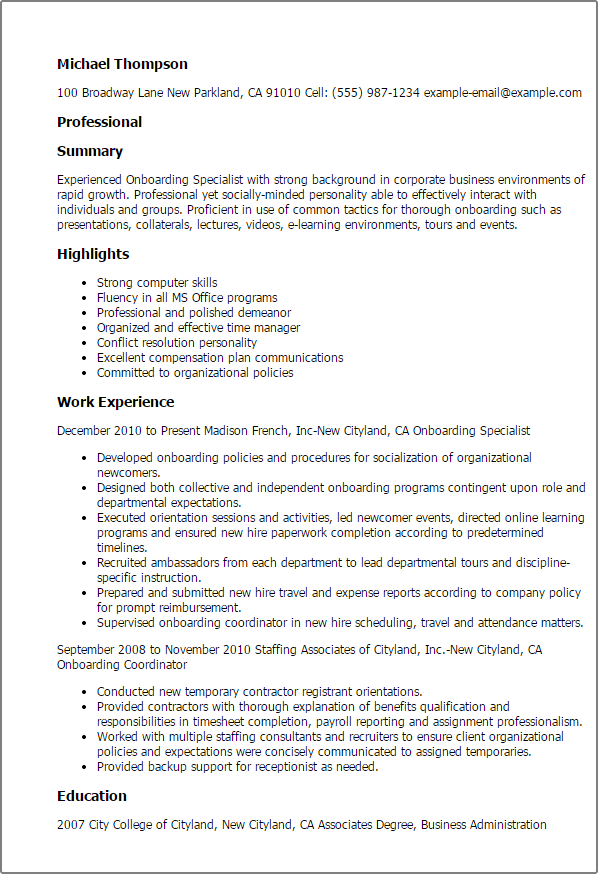

Onboarding Specialist Resume Examples & Templates

Onboarding specialists enjoy one of the most versatile and vitally important positions in the industry. Not only are they proficient in presentations, lectures, and e-learning environments, but they're incredible socially-minded,

Accounts Payable Specialist Resume Examples + Expert Tips

Explore accounts payable specialist resume examples that demonstrate how to showcase essential skills like invoice processing, vendor management, and attention to detail.Build my resumeImport existing resumeCustomize this templateWhy this

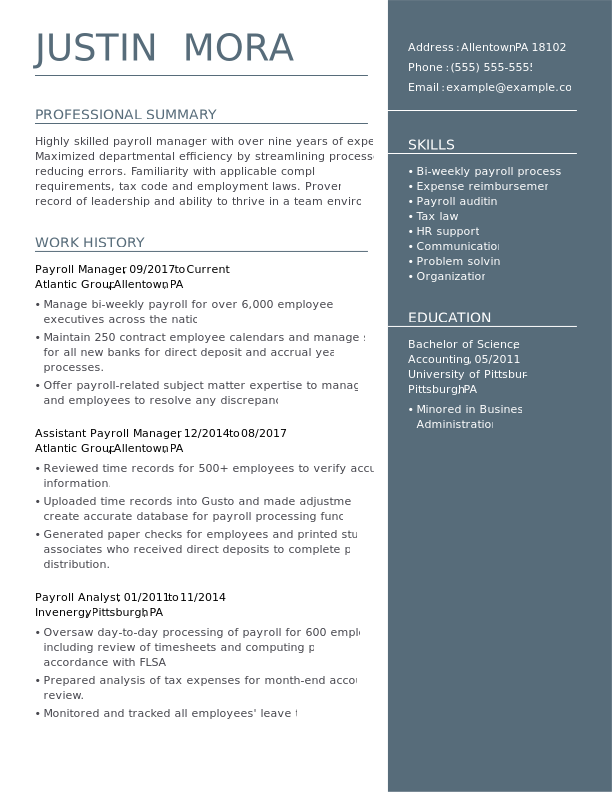

Payroll Manager Resume Examples & Tips

Payroll managers are responsible for handling employee payments. Duties include maintaining payroll records, calculating taxes and balancing payroll accounts. If you’re looking to get a payroll manager position, focus on