Tax Preparer Resume: Examples & Tips

- 30% higher chance of getting a job‡

- 42% higher response rate from recruiters‡

Our customers have been hired at:*Foot Note

A tax preparer is responsible for income tax preparation for individuals and companies, identifying potential tax credits and liabilities, and ensuring that accurate and complete returns are filed in a timely manner. This job requires extensive knowledge of tax regulations, attention to detail, and the ability to complete tax reforms in accordance with compliance legislation and regulations.

Follow our writing tips and resume examples on this page to craft a perfect resume to take your tax preparer career to the next level.

Get inspiration from 800+ resume samples and explore our professional resume templates to find the best one for you.

Tax preparer example (text version)

Name: ADAM ROSS

Address: City, State, Zip Code

Phone: 000-000-0000

E-Mail: email@email.com

PROFESSIONAL SUMMARY

Skilled entry-level Tax Preparer. Excellent at creating metrics, tracking projects and collaborating on development of budgets. Excellent relationship building, problem-solving, customer service and communication skills.

PROFESSIONAL SKILLS

Analytical skills

Company Name, City, State

- Calculated tax owed, prepared and submitted returns, and upheld

compliance with all applicable laws. - Reconciled balance sheets and streamlined best practices for balance sheet

processes. - Performed advanced reviews of business operational trends and expected

obligations to prepare accurate forecasts.

Detail-oriented

Company Name, City, State

- Reviewed budgets, including capital appropriations and operating budgets,

and communicated findings to senior management. - Methodically reviewed documents and accounts for discrepancies and

resolved variances. - Reconciled balance sheets and streamlined best practices for balance sheet

processes.

Communication

Company Name, City, State

- Performed advanced reviews of business operational trends and expected

obligations to prepare accurate forecasts. - Gathered and analyzed employee, department and company-wide financial

information. - Helped clients navigate interactions with tax authorities and legal concerns

related to financial matters.

SKILLS

- Financial analysis

- KPI Management

- Reporting and Documentation

- Budgeting

- Monthly reporting

- Date Analysis

- Invoice coding familiarity

- Advanced bookkeeping skills

WORK HISTORY

H &R Block – Tax Preparer

04/2019 – Current

Harrison & Associates – Accounting Intern

09/2017 – 05/2018

Charles Entertainment Cheese – Assistant Manager

02/2013 – 09/2016

SUMMERY OF QUALIFICATIONS

- Inspects account books and accounting systems for efficiency and use of accepted procedures

- Assess financial operations and make best-practices recommendations to

management - Suggests successful ways to reduce costs, enhance revenues, and improve profits

EDUCATION

BBA: Accounting ,City, State

See why MyPerfectResume is a 5-star resume builder

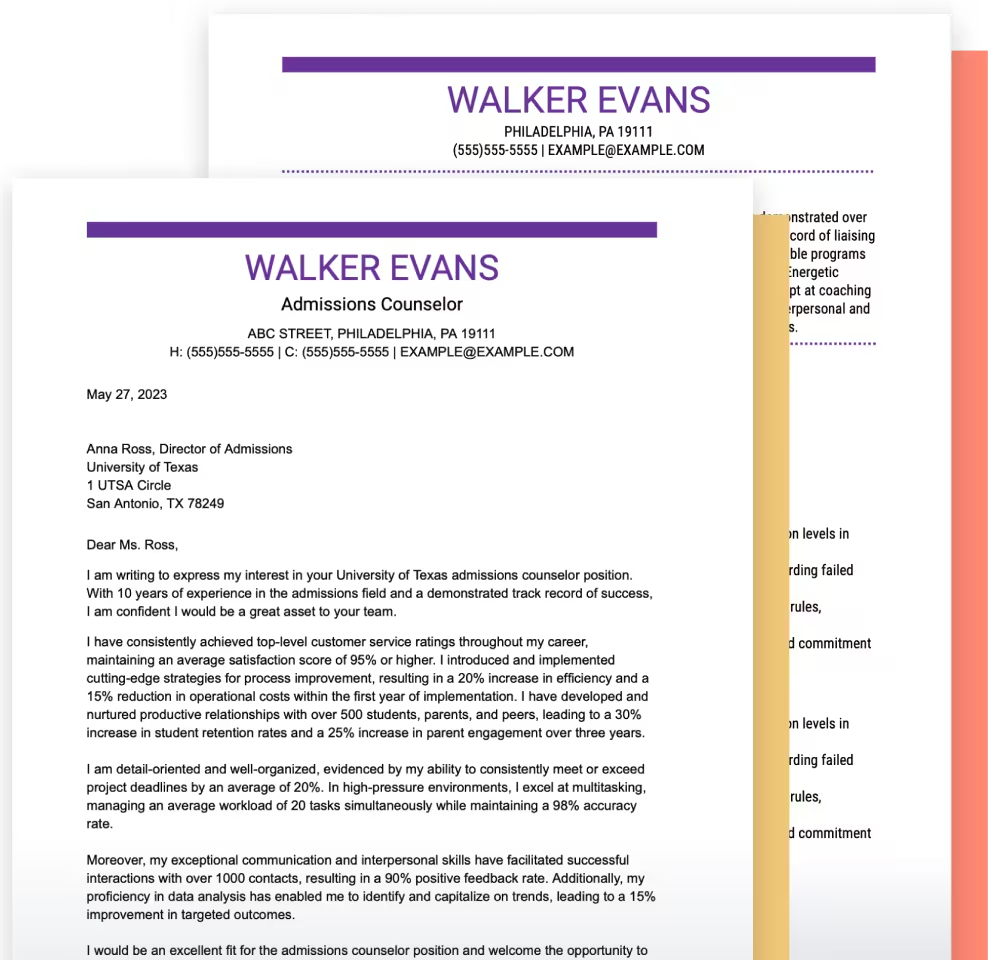

Pair your resume with a matching cover letter

Tax Preparer Resume FAQ

1. What makes a great tax preparer resume?

A best-in-class tax preparer resume is tailored to match the employer’s job description, in which your skills and work experiences match with the key requirements of the job. For example, if the job calls for “establishing rapport with clients to build working relationships and increase retention,” highlight experiences where you’ve built solid client relationships, and stress skills such as interpersonal communication. Include any training or extracurricular experiences pertinent to the position, house all this information in a clear, easy-to-read resume layout — no need to get fancy with design or resume fonts.

2. Should your resume have a summary statement or objective?

A resume objective, in which the job seeker states his or her career goals, is looked upon as outdated these days. Most recruiters prefer a summary statement which concisely communicates what an applicant can do for the company, and convey their top skills and accomplishments.

3. What skills should be featured in a tax preparer’s resume?

Some common skills that employers look for in a tax preparer include:

- IRS correspondence

- Tax audit procedures

- Year-end tax provision proficiency

- Local, state and federal tax returns

- Payroll familiarity

- Filing system management

4. Which is the best place to include contact details in a resume?

In a tax preparer’s resume, contact details should come in the header with the applicant’s name (as shown in the above examples). It should include your work/personal email address, city, state of residence, and links to your LinkedIn profile or professional portfolio website, if you have them.

5. What’s the best file format for a resume?

Typically, MS Word and PDF are the most common file formats for a resume. If you need some resume format that can be easily customized and downloaded in both Word and PDF format, pick from this collection of resume templates.

Do’s and Don’ts for Your Resume

- DO list relevant work history, skills, and education. Each job will have different requirements — read the job description carefully and pick out key phrases that describe work requirements, such as proficiency with QuickBooks, or experience managing multiple client engagements. Then match your own work experience skills, and accomplishments with these keywords as much as possible.

- DO use simple and direct language. Use simple phrases and bullet points when describing your skills and work experience. If you need to use acronyms, make sure you spell them out, e.g. “Taxpayer Identification Number (TIN).” Don’t expect hiring managers to be familiar with every term — when possible, keep things straightforward.

- DO write a concise resume. A recruiter spends only a few seconds to review a resume, on average. The longer your resume, the greater the chance a recruiter might miss important information. Try to keep your document just one-page long, and definitely don’t exceed two pages. Make sure your summary, skills and job accomplishments are geared to address the specific job you’re applying for, and don’t include irrelevant details.

- DON’T mention irrelevant personal information. A recruiter isn’t interested in reading about random hobbies or personal details (e.g., marital status, number of children) on a resume. Limit your personal information to your contact details(phone number, email address), and focus on filling your resume on strictly work-related qualifications.

- DON’T submit your resume before reviewing it. Tax preparation requires precision and accuracy above everything else — and a resume that has typos or factual errors conveys the exact opposite impression. Don’t submit your resume before reviewing it a few times, and making sure your information is up-to-date, correct, and presented without mistakes.

- DON’T lie or exaggerate. As a tax preparer, you will be entrusted with sensitive information and expected to maintain a high standard of professional and personal integrity. The same should go for your resume, which means no fibbing or exaggerating about your own accomplishments. If you lie on your resume and are caught, the repercussions can be serious. Stick to being honest about your abilities and qualifications.

Top 4 Characteristics of a Best-in-Class Tax Preparer Resume

Summary

The summary should quickly convince recruiters that you’re the right match for the job. If you are an experienced tax preparer, use this space to give some details on your career successes. If you have less experience, highlight your skills and show you’re motivated to excel.

Skills

Make sure you feature a balance of hard and soft skills that fit with what the job description requires You should consider dividing your skills into categories, such as “Tax preparation skills” (e.g. strong understanding of tax processes) and “soft skills” (e.g., analytical skills, attention detail and communication).

Work History

Highlight achievements that show employers using metrics to demonstrate your effectiveness. For example: “Processed 100+ tax returns per week with less than 1% errors.” Elaborate on your roles and responsibilities, such as preparing corporate, fiduciary, gift, individual or private foundation returns.

Education

Include your top education credential (e.g., college graduate degree/diploma) along with any certifications that relate to financial work, such as state tax preparer certification.