Personal Banker Resume Examples & Tips

- 30% higher chance of getting a job‡

- 42% higher response rate from recruiters‡

Our customers have been hired at:*Foot Note

Personal bankers assist clients with money management, minimizing risk, and maximizing returns. This job covers tasks like explaining bank products to customers, opening and closing accounts, discussing loan requirements, and directing investments in money markets, CDs, and other financial vehicles.

Follow our resume examples and tips to create a resume that earns you a personal banker position.

Get inspiration from 800+ resume samples and explore our professional resume templates to find the best one for you.

Personal banker example (text version)

Name: NICK BARNES

Address: City, State, Zip Code

Phone: 000-000-0000

E-Mail: email@email.com

PROFESSIONAL SUMMARY

Accomplished Personal Banker driven to increase branch revenue through innovative sales strategies. Adept in client relationship building with in-depth knowledge of financial product and business assessment expertise.

WORK HISTORY

Personal Banker, 06/2018 to Current

Company Name, City, State

- Assisted customers with setting up or closing accounts, completing

loan applications and signing up for new services. - Helped clients plan for and fund retirements using mutual funds and

other options to manage, customize and diversify portfolio. - Built 16 referral business opportunities in 2019, expanding both the

consumer and small business client base.

Licensed Personal Banker, 10/2015 to 02/2018

Company Name, City, State

- Partnered with local organizations to provide specialized financial

planning support to diverse populations with unique needs. - Boosted sales by 15% and exceeded sales target by employing

consultative sales tactics and superior customer care. - Provided strong customer service, including listening carefully,

assessing needs and responding to clients’ questions and issues.

Banking Assistant, 02/2011 to 10/2014

Company Name, City, State

- Completed timely and efficient administrative functions, including receiving and sorting mail, preparing packages for delivery and scanning documents.

- Processed vendor and supplier payments on weekly basis.

- Used data entry skills to accurately document and input statements.

SKILLS

- Financial services

- Banking

- Financial advisement

- Financial product knowledge

- Portfolio assessment

- Sales expertise

SUMMERY OF QUALIFICATIONS

- Opened new accounts and assisted with transactions as needed.

- Develop new banking relationships and deepen existing relationships through recommending relevant products and services to the branch’s clientele.

- Provided credit, deposit or other banking services as well as counsel and advice to best meet clients’ needs.

EDUCATION

BBA,Accounting And Business

Management,City, State

See why MyPerfectResume is a 5-star resume builder

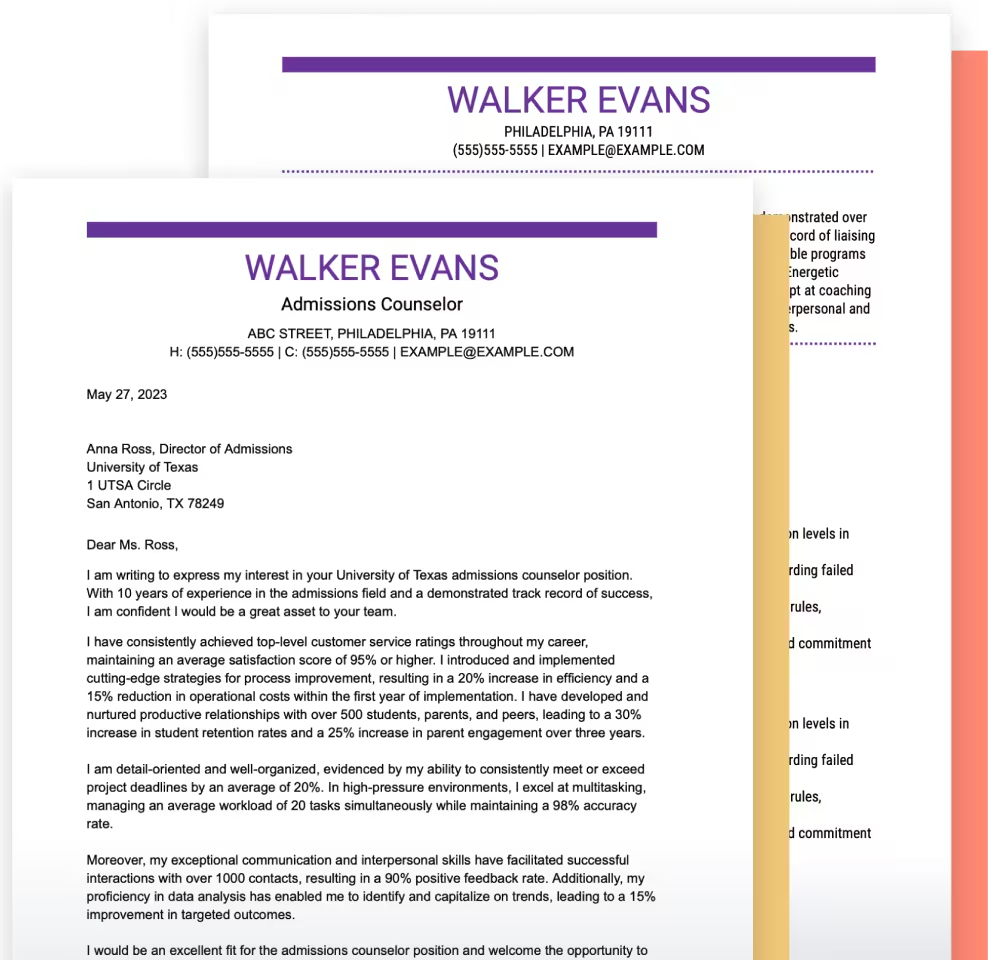

Pair your resume with a matching cover letter

Personal Banker Resume FAQ

1.Why give more emphasis to work achievements than everyday duties?

Chances are that other candidates for this job will have similar tasks and responsibilities from their job histories. The way to set yourself apart is to show how you’ve specifically added value or made a major impact with previous employers, so focus on your achievements, highlighting details and numbers wherever possible. For example: “Managed profitable lending and deposit relationships with 50 small business clients.”

2. How should you approach your resume summary?

Think of your summary as an “elevator pitch” — a quick overview of your strengths that explains why you’re a good fit for the job. Communicate the value you can bring as an employee, emphasizing top traits that address what the job needs. Just use our examples on this page as a guide.

3. What skills should you consider for a personal banker resume?

- Knowledge of banking services

- Financial advice

- Proficiency with job-specific software

- Financial trend analysis

- Risk management

- Client management

- Interpersonal skills

- Attention to detail

- Financial product knowledge

- Portfolio assessment

- Sales expertise

4. How should you add keywords to your resume?

Employers and the applicant tracking systems (ATS) they use to scan resumes will grade your document based on your keywords. To get the right keywords, read through the job description and note phrases that define the job’s top requirements (e.g., “assisting clients with consumer loan applications”). Match these requirements up with your skills and experiences, and feature them in your resume (e.g., writing “loan application management” in your skills section or presenting a previous work experience that assisted clients with loan applications. For more on customizing your resume, see our article How to Create a Targeted Resume.

5. What’s the best file format for a resume?

Typically, MS Word and PDF are the most commonly used file formats for a resume. These formats enable you to use different fonts and elements to create a professionally impressive resume that can be read almost universally. Our Resume Builder can export your resume in both Word and PDF formats, so take advantage of it when creating your resume.

Do’s and Don’ts for Your Resume

- DO tailor your resume to the job. Experienced hiring managers can spot a generic “one size fits all” resume with just a glance. Rather than trying to shoehorn in all your skills and achievements, focus on highlighting skills and experiences that match the job description for the role you’re applying for. Address the position’s primary requirements through related skills and career accomplishments. For more advice on customizing your resume, see our article How to Create a Targeted Resume.

- DO keep it short and crisp. Employers spend only a few seconds scanning a resume, on average, so keep your document short and sweet, using concise phrases and bullet points instead of long-winded sentences. Focus on your most relevant qualifications instead of listing everything you’ve ever done. Limit your work history to the past 10 years.

- DO double-check your document. Make sure you review your resume before sending it out, looking out for any spelling or grammatical errors, not to mention any details that might be inaccurate, out of date, or irrelevant. If you use our Resume Builder to create your resume, its built-in tools will also review your document.

- DON’T include references. There is no need to include references in your resume or even write “References available upon request” unless the recruiter specifies you do so. You have limited space to make the right impression, so devote your resume to your achievements and most important credentials. Keep a separate reference list that you can send in if needed.

- DON’T use an unprofessional email address. Even something meant in the spirit of fun, such as an email address that contains “coolcat,” can make the wrong impression on a hiring manager. Keep your email address simple and professional — use an email with a username that contains your first and last name, and if necessary, a number or two.

- DON’T share irrelevant personal information. Refrain from sharing personal details such as religion, birth date, and marital status. Hiring managers only need to know your contact details (such as phone number and email address), so don’t give them any reason to potentially discriminate against you, and limit yourself to career and education details that directly address the job.

Top 4 Characteristics of a Best-in-Class Personal Banker Resume

Summary

Convince recruiters you’re the right fit for the job by highlighting your best, most relevant skills and expertise in your summary statement. For example, when applying for a job that stresses strong customer service, communication, and conflict-management skills, feature these attributes, as in our example.

Skills

As this position relies on the ability to build strong and lasting relationships with customers, emphasize soft skills such as verbal and written communication, a positive approach, and attention to detail, as well as hard skills such as knowledge of specific software, analytical skills, and an understanding of financial documents.

Work History

List your accomplishments rather than everyday tasks, and boost them using tangible details and stars. For example, writing “boosted sales by 15%” and “supported assigned client base of 150 consumers” gives recruiters a better understanding of your capabilities.

Education

Include your top education credential (e.g., a college degree in accounting, business management or related field) along with any additional training or certifications, such as completion of an ABA Personal Banker Certificate program.

CV examples for the next step in your finance career

- Financial Advisor

- Financial Analyst Cover Letter

- Personal Banker Cover Letter

- Tax Preparer Cover Letter

- Bank Branch Manager CV

- Board Director CV

- Consultant CV

- Credit Risk Analyst

- Equity Research Analyst CV

- Estimation Engineer CV

- Financial Advisor CV

- Forex Trader CV

- Fund Manager CV

- Investment Banker CV

- Project Assistant CV

- Tax Manager CV

- Treasury Accountant CV

- Treasury Manager CV