Loan Officer Resume Guide + Tips + Example

- 30% higher chance of getting a job‡

- 42% higher response rate from recruiters‡

Our customers have been hired at:*Foot Note

Does a career as a loan officer appeal to you? Then you need a great loan officer resume. We’re here to help. Check out our resume guide and our loan officer resume examples to learn how to write a resume that advances your career!

Start by editing this loan officer resume template, or explore our library of customizable resume templates to find the best one for you.

Loan officer resume example (text version)

JAMES SAUNDERS

Detroit, MI 48071

555-555-5555

example@example.com

Skills

- Practiced at FHA loan process

- Deep knowledge of bankruptcy processes

- Strong banking ethics

- Financial analysis aptitude

- Moody’s KMV CreditEdge

- Experian Transact SM

- Financial transactions expertise

- Financial advising

Education

- Michigan State University Lansing, MI

Bachelor of Science Finance - Graduated summa cum laude

Professional Summary

Multitalented loan officer consistently rewarded for success in planning and operational improvements. Experience in policy development and staff management procedures, positively impacting overall morale and productivity. Demonstrating strong interpersonal skills and exceptional service throughout the sales process.

Work History

July 2016 – Current

Southern Michigan Bank & Trust – Pontiac, MI

Loan Officer

- Develop and maintain relationships with local real estate agents, increasing referrals by 35%.

- Successfully closed an average of two to three loans per month.

- Develop prospects for new loans by conducting 20 cold calls weekly.

April 2014 – June 2016

Quicken Loans – Detroit, MI

Loan Officer

- Originated, reviewed, processed, closed and administered up to 25 customer loan proposals per year.

- Advised over 30 clients per day on mortgage, education and personal loans.

- Assessed clients’ financial situations to develop strategic financial planning solutions.

June 2012 – March 2014

Compass Credit Union – Detroit, MI

Loan Officer Assistant

- Communicated with customers daily to request information and ensure completion of paperwork.

- Assembled important paperwork and disclosures for the borrower.

- Monitored key dates to ensure information is obtained by deadlines.

5 essentials of a top loan officer resume

Contact details

Add your contact information to the top of your resume so hiring managers know how to reach you. As our loan officer resume sample shows, your contact information must include your full name, city, state and ZIP code, phone number and professional email address. If you have a LinkedIn profile and professional website, add them too. Make sure that your contact information is accurate and up to date so that hiring departments can get a hold of you.

Personal statement

A personal statement, also known as a professional summary, is a concise, three-to-five-sentence statement that describes your qualifications, career achievements and goals. Your summary should include your job-relevant skills and a few accomplishments. It should also briefly describe your career history. If you are applying for your first job or changing careers, use a loan officer resume objective instead. A resume objective focuses more on skills and less on experience.

Skills

The skills section of your resume shows hiring managers that you have the skill set that they’re looking for. Add your job-relevant hard and soft skills for a loan officer resume that really packs a punch. Your skills section should organize these abilities using a bulleted list that’s easy to read.

Work history

A good resume is vital for experienced loan officers and newcomers alike. A persuasive resume for a loan officer must include a section that describes your work experience. Organization names, dates and locations should be provided for your previous roles. It is best to organize these in reverse-chronological order. Include measurable achievements from each role.

Education

A loan officer resume must include an education section, where you can list your degrees, colleges, universities and graduation dates. If you did not attend college, it is still a good idea to include your high school and any other schooling or vocational training you’ve received.

See why MyPerfectResume is a 5-star resume builder

Action verbs for a stand-out loan officer resume

Use action words and numbers to add impact to your resume.

Here’s a short list of perfect action words for a loan officer resume:

- Assess

- Analyze

- Negotiate

- Navigate

- Perform

- Prepare

- Maintain

- Organize

- Communicate

- Observe

- Report

- Advise

- Schedule

- Engage

- Plan

Check out our collection of resume samples to help you write the perfect resume for a loan officer job. Our loan officer resume samples are the perfect place to find some inspiration for your own resume!

Need a professional resume as soon as possible? Our Resume Builder provides the tools you need to create a professional resume in just a few minutes! All you have to do is fill in your information and the Resume Builder will do the tricky stuff for you!

Top skills for a loan officer resume

Review the job description closely and match the required skills to the skills and traits that fit you.

Some loan officer resume skills might include the following:

- Verbal communication

- Salesmanship

- Negotiation

- Attention to detail

- Interpersonal

- Advocacy

- Planning

- Assessing

- Problem-solving

- Critical thinking

- Persuasion

- Empathy

- Relationship building

Certifications for a loan officer resume

There is no single certification that a loan officer must have. However there are many useful certifications and a few which are necessary for dispensing certain types of loans.

The following certifications can boost your resume:

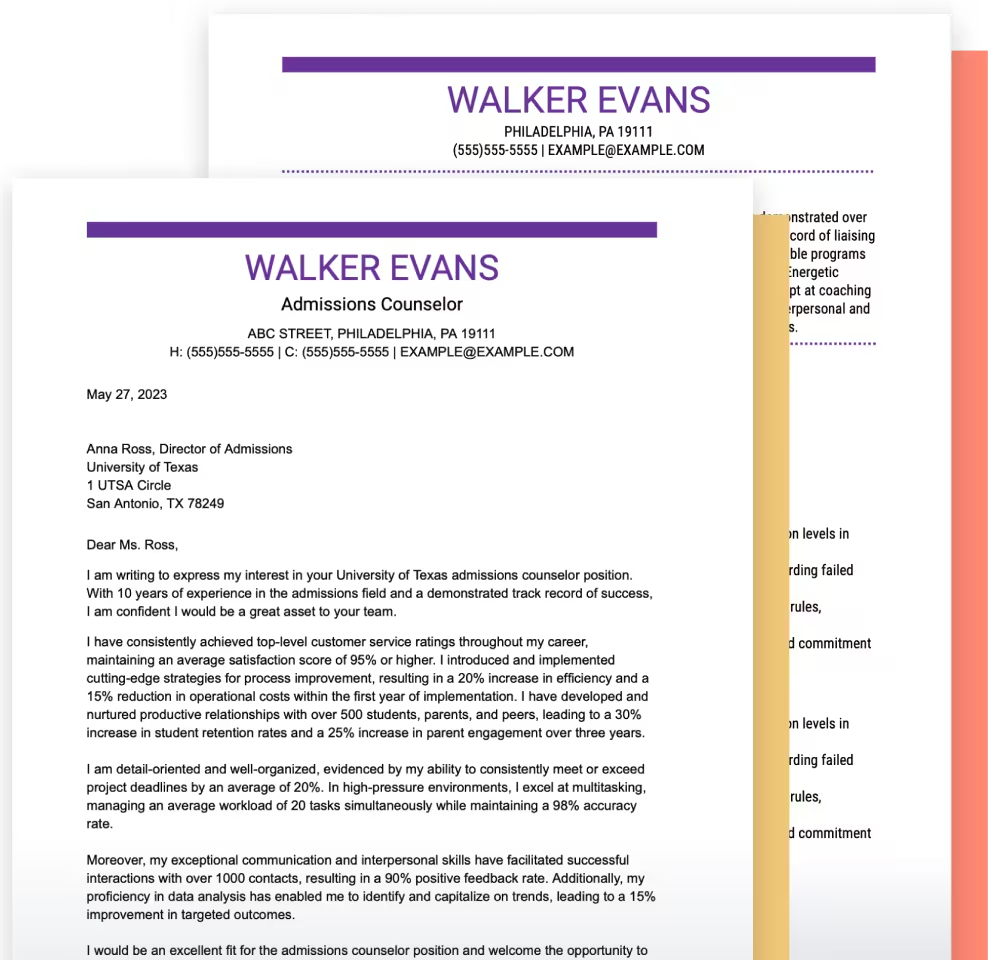

Pair your resume with a matching cover letter

Loan officer resume FAQ

What should I put on my loan officer resume?

Your loan officer resume should include your relevant qualifications, including experience, education and skills. Be sure to read the loan officer job description for resume keywords that you can use. Many employers use applicant tracking systems (ATS) to scan applicant resumes. Incorporating keywords from the job description is a great way to take advantage of this.

How to talk about a loan officer position on your resume?

Each loan officer position comes with its own set of challenges and responsibilities. Try to avoid using common resume cliches while you list your loan officer duties. Resume work experience entries can be repetitive when applicants use the same few verbs repeatedly. Try substituting some of those overused resume words, like “responsible for,” with action-packed verbs that convey the impact of your work.

What should a resume look like when applying for a loan officer position?

The resume format you use depends on your experience and goals. Experienced loan officers should choose the chronological resume format, which highlights work history. If your career is just getting started, a functional resume format is a strong choice because it focuses more on training and skills. If you have a mix of experience and training, you may want to choose the combination resume format, which focuses on experience, achievements, skills and training. Be sure to take a look at our library of loan officer resume templates to get a sense of how to organize your resume visually.

Do’s and don’ts for building a loan officer resume

- Use measurable achievements to describe your loan officer abilities and experience.

- Use action words to make an impact on your loan officer resume.

- Tailor your resume to your target loan officer job.

- Use keywords from the job description throughout your loan officer resume.

- Format your loan officer resume so that it is easy to read by ATS software and human eyes.

- Lie about your loan officer experience and skills.

- Boast that you’re the “best loan officer ever.”

- Include irrelevant personal information such as your ethnicity and age.

- Add skills and experience not about being a loan officer.

- Forget to proofread. A loan officer’s resume with errors is unprofessional.

Top 4 tips for acing a loan officer interview

Research.

It’s vital to take the time to learn about the company’s history, goals, values and people before the interview. Doing so conveys interest, passion and commitment — traits that can set you above the competition.

Practice.

Practice does make perfect. To prepare for your interview, start by reviewing the most common interview questions, such as:

- Why did you choose this career?

- Who are your heroes?

- What was the toughest challenge you’ve ever faced?

Write down two or three possible answers for each question, then practice answering them with a friend.

Ask questions.

Always have at least three questions for each person you speak with during the interview process. Doing so shows that you’re interested and have been paying close attention.

Some questions you might ask for a loan officer job are:

- What is the clientele like?

- What are the biggest challenges of this role?

- What are the expectations for this role?

Prepare references.

Have professional references ready before you interview — you never know if the hiring manager might want to contact them immediately. Ask a former manager and two former colleagues who can speak about your performance and who you know will give you an excellent review.