Accounts Payable Clerk Resume: Examples & Tips

- 30% higher chance of getting a job‡

- 42% higher response rate from recruiters‡

Our customers have been hired at:*Foot Note

An accounts payable clerk maintains and processes accounts payable transactions. Duties include preparation of bills, logging invoices, verifying, computing, and recording data, keeping track of expenditures and payments, and providing support documents for audits. To excel in this job, you should be detail-oriented, be able to meet deadlines, have excellent communication skills, and can be trusted with confidential information.

To create an impressive accounts payable clerk resume, refer to our tips and resume examples below:

Get inspiration from 800+ resume samples and explore our good resume templates to find the best one for you.

Accounts payable clerk example (text version)

Name: RONNY MATHIS

Address: City, State, Zip Code

Phone: 000-000-0000

E-Mail: email@email.com

PROFESSIONAL SUMMARY

Precise accounts payable clerk with a proven track record of success in keeping finances up-to-date and accurate. Dedicated to performing on-time staff, vendors and supplier payments. Offering seven years of functional experience in providing clerical, financial, and administrative services.

WORK HISTORY

Accounts Payable Clerk,

05/2017 to Current

Company Name, City, State

- Processed daily bills, checks and vendor payments worth over $15,000, maintaining detailed records and receipts.

- Monitor, verify and approve up to 1,200 invoices pr week and review balances using financial software to assess balance sheet for variances.

- Manage efficient and accurate processing of invoices and check requests for five locations.

Accounting Clerk,

10/2015 to 04/2017

Company Name, City, State

- Reported financial data and updated financial records in ledgers and journals.

- Processed payroll for approximately 300 employees.

- Balanced reports to submit for approval and verification.

Bookkeeper,

07/2013 to 10/2015

Company Name, City, State

- Eliminated discrepancies in finances by expertly documenting expenses, monitoring income, handling bank deposits and managing statements.

- Maintained account accuracy by reviewing and reconciling checks monthly.

- Established QuickBooks accounting system to reflect accurate financial records.

SKILLS

- General ledger accounting

- Vendor invoice processing

- Account reconciliation

- Month-end closing

- Generating reports

- Communication

- Time management

- Organization

Education

Bachelor of Science, Accounting, 05/2013 ,City, State

See why MyPerfectResume is a 5-star resume builder

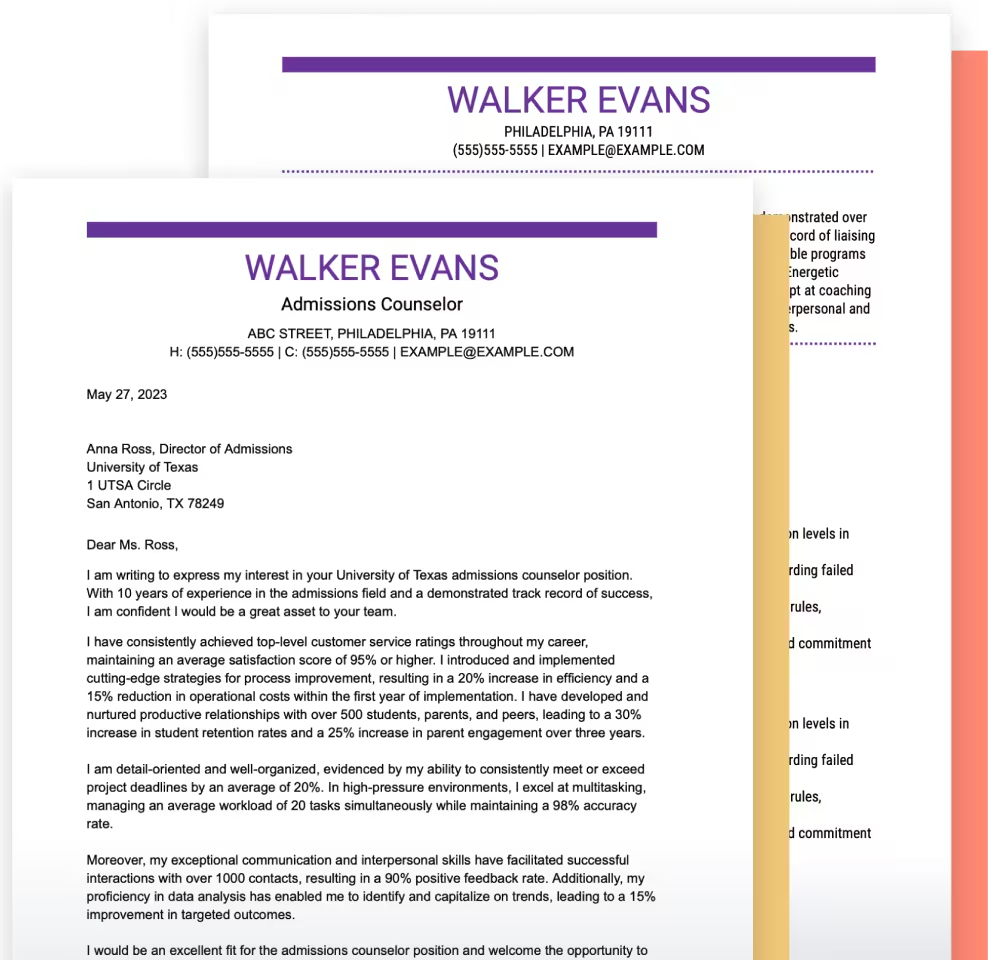

Pair your resume with a matching cover letter

Accounts Payable Clerk Resume FAQ

1. What are the skills you should emphasize for an accounts payable clerk position?

| Technical skills: | Soft skills: |

| Proficiency with Microsoft Office | Effective communication skills |

| In-depth knowledge of accounting principles | Strong time management skills |

| Ledger entry and maintenance | Eye for detail |

| Data entry | Honest and reliable |

| Advanced Excel knowledge | Dependability |

| Knowledgeable in Sage X3 and Oracle Netsuite | Ability to work independently |

| Generating reports | Good analytical skills |

| Accounting reconciliation | Organizational skills |

| Understanding of accounts and budgets | Customer service orientation |

| Hands-on experience with spreadsheets | High numerical aptitude |

| Invoice processing | Negotiation skills |

| Auditing | Results-oriented |

| Multitasking | |

| Flexibility | |

| Confidentiality | |

| Professional integrity | |

| Problem-solving skills | |

| Strong work ethics |

| Technical skills: |

| Proficiency with Microsoft Office |

| In-depth knowledge of accounting principles |

| Ledger entry and maintenance |

| Data entry |

| Advanced Excel knowledge |

| Knowledgeable in Sage X3 and Oracle Netsuite |

| Generating reports |

| Accounting reconciliation |

| Understanding of accounts and budgets |

| Hands-on experience with spreadsheets |

| Invoice processing |

| Auditing |

| Soft skills: |

| Effective communication skills |

| Strong time management skills |

| Eye for detail |

| Honest and reliable |

| Dependability |

| Ability to work independently |

| Good analytical skills |

| Organizational skills |

| Customer service orientation |

| High numerical aptitude |

| Negotiation skills |

| Results-oriented |

| Multitasking |

| Flexibility |

| Confidentiality |

| Professional integrity |

| Problem-solving skills |

| Strong work ethics |

2. How should I format my resume?

If you have a few years of accounting experience, use a combination format, which emphasizes both your work history and top skills. Use a functional resume if you are a fresh graduate or lack experience, as this focuses on the skills you already have that match the job. If you have more than five years’ experience in the field, go with a chronological resume, which highlights your work achievements. For more tips on choosing the right format, visit our Resume Format page.

3. How should I customize my resume if I want to take the next step forward in my career?

Look to continue developing your managerial abilities, and highlight the following in your resume:

- An advanced degree or training in accounting, finance, business management, or any other related field.

- Further training and certifications (e.g., courses or workshops) to become a certified professional accountant.

- Work examples where you’ve maintained ledgers, helped reduce overpayments, and found solutions for data inconsistencies to improve company profitability.

- Showcase instances where you utilized problem-solving and analytical skills to make a positive impact.

4. How can I choose the right keywords for the resume?

Employers often use applicant tracking system (ATS) to scan resumes, and filter out unworthy candidates. To pass ATS, use the right keywords in your resume. Review the job listing, and take note of phrases that pinpoint prime job requirements. Some examples of keywords could include “in-depth knowledge of bookkeeping,” “ability to work under pressure,” or “time-management skills.” You can also visit the company’s website to pinpoint additional keywords connected with its mission and approach to work. Match these keywords with your own abilities, and mention them in your resume’s summary, skills and work history sections (e.g., listing “time management” in your skills section). For more (ats) tips, see our page How to Write an ATS-Friendly Resume.

5. What are some examples of training and certifications you can feature for an accounts payable clerk role?

If you have additional certifications and training in your field, create a separate “Certifications and Training” section on your resume to feature credentials such as the following:

- CAPA (Certified Accounts Payable Associate)

- CAPP (Certified Accounts Payable Professional)

- A certificate in AP software such as QuickBooks, Sage or NetSuite

Do’s and Don’ts for Your Resume

- DO feature relevant soft skills To excel at an accounting job, you need technical skills like proficiency in computer software and data entry, but you also need intangible abilities (aka soft skills) such as problem-solving, time management, attention to detail and customer service. Recruiters will look for soft skills on your resume, so be sure to feature them alongside your hard skills, and mention them in conjunction with your work accomplishments (e.g., “Utilized exceptional negotiation skills to handle client repayments”). Our resume skills tips page provides even more tips on how to utilize soft (and hard) skills.

- DO quantify your accomplishments When recounting your work accomplishments, use numbers and metrics to better define your effectiveness. Show potential employers that you can produce bottom-line results. For example: “Audited invoice processing, reducing overpayments by 23%” or “Verified 75+ incoming invoices every month to detect errors, resulting in annual savings of 60%.”

- DO keep your resume concise. On average, recruiters take only a few seconds to skim a resume. Avoid unnecessary information and stick to work achievements and skills that have a direct bearing on the job you want. Keep your sentences brief and punchy. For example, rather than writing “Entered financial transactions into the internal database and ensured 100% accuracy rate in full compliance with internal policy,” write “Maintained 100% accuracy rate in financial transactions, ensuring policy compliance.”

- DON’T use first-person pronouns in your resume. Eliminate the use of first-person pronouns like “I,” “my” and “me” — instead, use metrics and details that convey more information. For example, instead of writing “I was responsible for coding invoices into accounting software,” you could write “Coded and entered 150+ invoices per day into accounting software.”

- DON’T submit your resume without reviewing it. Proofread your resume for grammar and spelling errors, and go through each section one more time to make sure your information is accurate. You can also use our Resume Builder to help check your document.

- DON’T include references. In your resume, recruiters are more interested in knowing about the skills and experiences that tell them why they should hire you. Unless you’re specifically requested to list your references in your resume, keep them in a separate document — employers will let you know when and how to submit them, if needed. For more tips on putting together your references, visit our resume references how-to page.

Top 4 Characteristics of a Best-in-Class Accounts Payable Clerk Resume

Summary

In a few concise sentences, highlight your work experience and top skills. Scan the job description carefully and find common threads that align with your abilities. For example, for an accounts payable clerk job that favors account management experience and Microsoft Office skills, you could write: “Highly motivated accounts payable clerk with 5+ years of extensive experience in account management. Excellent proficiency in MS Office tools.”

Skills

As with the summary, feature skills that fit the requirements of the specific job you’re applying for. Present a mix of technical skills (e.g., familiarity with SAP and MS Office applications, payment processing or financial reporting) and soft skills (e.g., time management, multitasking, negotiation skills and customer service).

Work History

Mention relevant accounting experiences (for example, bookkeeper, account assistant or junior clerk) in reverse-chronological order, showcasing how you’ve progressed in your career. Use bullet points and punchy phrases. Quantify your achievements to give employers a better understanding of how you’ve brought value to previous organizations. For example: “Maintained 100% accuracy in calculating the company’s expenses to decrease discrepancy rate.” As a rule of thumb, limit your work history to the past 10 years.

Education

List the highest qualification you have, such as a bachelor’s degree in accounting, finance, economics, business studies, or a related field, along with any training or certifications you have related to accounting and bookkeeping, such as data entry, spreadsheet software, or accounting software such as FreshBooks, QuickBooks, and Sage.